Insurance markets in the US traditionally have been regulated at the state level. This tradition was reinforced by the 1945 McCarran–Ferguson Act, which exempted the business of insurance from federal antitrust oversight as long as the individual states regulated the insurance business. Much of the early health insurance regulation related to reserve requirements and sales practices although the states did impose premium taxes. The number and types of mandates proliferated in the past 40 years.

Insurance mandates are defined as state laws that require a health insurer to include specific categories of individuals, providers, or services within the scope of coverage provided. Less restrictive laws only require that the insurer offer specific coverages to purchasers. Some analysts also have included laws affecting specific types of insurers, particularly managed care plans, as insurance mandates as well. The early mandates of the 1950s tended to expand the cohort of covered persons to include newborns and handicapped children. Thus, if a policy was to be sold in the state it must include coverage for newborns.

Prevalence Of State Insurance Mandates

Most mandates apply to employer-sponsored health insurance coverage, although nongroup mandates also exist. There were few statutes until the 1970s when the number of laws began to proliferate. Although they only consider provider and service mandates, Laugesen et al. (2006) reported that of nearly 1500 state mandates enacted between 1949 and 2002, 12% were enacted in the 1970s, 25% in the 1980s, 39% in the 1990s, and another 16% in the first 3 years of the 2000s.

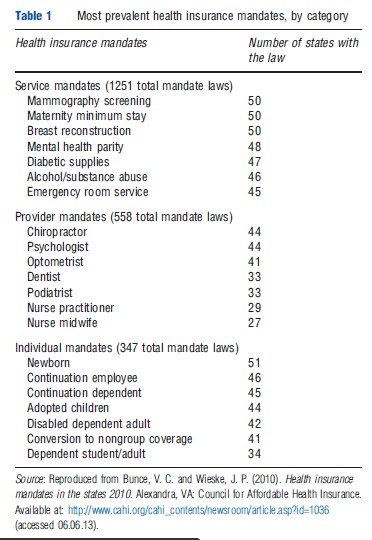

The Council for Affordable Health Insurance annually compiles a listing of all state health insurance mandates (Bunce and Wieske, 2010). Their 2010 edition reports the presence of 2156 mandates. The states display considerable heterogeneity in the number of mandates they enact. Idaho and Alabama have the fewest mandates with 16 and 19 provisions, respectively. Four states (Rhode Island, Maryland, Minnesota, and Texas) each have more than 60 provisions. Table 1 reports the most common mandates by category.

Federal Insurance Mandates

It is only relatively recent that the Congress has enacted health insurance mandates. The first was the 1979 Pregnancy Discrimination Act, which required that pregnancy be covered as a medical condition in most employer-sponsored plans. The 1986 Consolidated Omnibus Budget Reconciliation Act provided continuation coverage for 18–36 months for persons separated from employer-sponsored coverage. In 1996, the Health Insurance Portability and Accountability Act, (first) Mental Health Parity Act, and Newborns and Mothers’ Health Protection Act were enacted. Other federal laws followed. The enactment of state and federal mandates is not independent of each other. As Laugesen et al. (2006) noted, 50 jurisdictions had enacted breast reconstruction legislation by the time the federal legislation was passed in 1998 and 32 states had enacted maternal and newborn minimum stay provisions before or coincident with the 1996 federal legislation. These patterns suggest a common underlying demand for the legislation and may suggest that the federal legislation is merely a reflection of extant state practice.

Rationales For Mandates

There are three rationales for the enactment of a mandate. The first is lack of knowledge. The argument is that individuals and their employer agents underestimate the value of the coverage. By requiring coverage people get the coverage they would have purchased had they been better informed. The second rationale is adverse selection. The argument holds that both low- and high-probability individuals would like to buy the coverage, for, say, in vitro fertilization. However, when a single insurer offers the coverage those with a high probability of use are disproportionately attracted to the plan, raising plan premiums substantially. The higher premiums lead low probability users to forego coverage. Had the coverage been in all plans, the cost of insurance would have risen only slightly. Thus, mandating coverage allows low risk individuals who value the coverage to actually obtain it at premiums they were willing to pay. The third rationale is one of public choice. The argument is that advocates of a particular mandate will tend to be the providers of the particular service who petition the state legislature for statutes that expand coverage for themselves, the services they provide, and the people who are most likely to use their services. Opponents will be individuals and their employer and/or insurer agents who directly or indirectly face the costs of the law. There has been no empirical work testing the first two rationales. The public choice approach enjoyed some research interest in the 1990s with attention focused on mental health services and laws affecting the composition of managed care provider panels, all with results consistent with the public choice argument (see Jensen and Morrisey, 1999 for review).

One implication of the public choice model is that opposition should be reduced when potential opponents are exempt from the law. The Employee Retirement and Income Security Act (ERISA) of 1974 effectively made larger employers exempt from state insurance regulations. From this perspective it is not coincidental that the growth of state mandate legislation began in the 1970s when key elements of the opposition no longer benefited by expending political capital to oppose the laws.

To try to control the proliferation of mandates, half of the states have enacted mandated benefit review laws, which provide for a review of factors such as the cost and social impacts, medical efficacy, and quality of care before the legislature votes on a prospective mandate. There has been no evaluation of the effectiveness of these laws.

Economics Of Employer-Sponsored Health Insurance And State Insurance Mandates

Maximizing behavior on the part of employees and employers implies that workers are paid what they are worth, i.e., their marginal revenue product. Compensation may take many forms: wages, pensions, vacations, health insurance, etc. However, adding an element to the compensation package, other things equal, necessitates taking something else out. When a mandated benefit is added to the bundle the premium will increase. If premiums increase, wages or some other form of compensation must be reduced.

If workers do not sufficiently value the new compensation package they will seek employment in firms that do not offer the new costly benefit or may choose compensation that excludes health insurance entirely. Firms may seek a legal status that exempts them from the mandate. If wages or other forms of compensation can not adjust, perhaps because of minimum wage laws, one would expect reductions in employment. In the following four sections, the empirical evidence associated with these hypotheses will be explored.

Cost Of Mandates

The key issue in the chain of economic logic is that a mandate results in higher health insurance premiums. There are three issues bound up in this straightforward proposition. The first question is whether a particular benefit raises the health insurance premium of a firm that now must provide the new coverage. Second is the question of the cost of the mandate, per se. Suppose a chiropractor coverage mandate would raise premiums by US$10 per worker per month, but employees are willing to pay US$6. The benefit cost is US$10, but the cost of the mandate is only US$4 per worker. Finally, if the firm already offers the coverage that is the subject of the mandate, then there is no cost to the mandate for the firm or its workers. The cost of the legislation is the extra burden it imposes, not necessarily the dollar cost of the benefit.

Many of the cost analyses of health insurance mandates are actuarial studies. These works draw on a distribution of the likely claims experience for a health service, such as chiropractic care. The expected claims experience per worker is the additional cost of insurance to a firm that did not offer the benefit previously. Bunce and Wieske (2010) provided ranges of actuarial costs for each of the mandates they report. Mental health parity (e.g., covering mental health illnesses equivalently to physician health illnesses) would increase premiums by 5–10%, in vitro fertilization by 3–5%, alcoholism/substance abuse by 1–3%, and most other coverages by less than 1%. Kominski et al. (2006) used an actuarial model to estimate the costs of seven proposed mandates in California. The costs of these relatively small-scale mandates were estimated to increase premiums by 0.006–0.2%. The actuarial approach overstates the cost of a mandate for two reasons. First, additional services used under the new benefit may offset, somewhat, utilization of other services that were already covered. Second, workers are likely to have been willing to pay something for the mandated coverage, and indeed, some may already have the coverage.

In principle the first problem is easy to overcome. One could estimate a firm specific hedonic premium regression that includes various benefits along with a set of control variables. The coefficients on the specific benefits reflect the premium cost of adding each benefit, given the coverage already provided by the firm. Thus, any service substitution is accounted for. Unfortunately, this is not an estimate of the cost of a mandate, per se; rather it is the net cost of the benefit to the firm (see Jensen and Morrisey, 1999 for review).

Acs et al. (1992) were the first to directly estimate the presence of state insurance mandates on the premiums paid by firms. Using a cross section of more than 2500 firms in 1989, they concluded that each additional mandate increased health insurance premiums for large firms by US$1.50. Although this is a direct estimate of the cost of mandates, it is not without problems. First, the count of the number of mandates in a state forces each mandate to have an equal effect. Almost certainly some mandated benefits are substantially more costly than others. Second, the estimate is likely endogenous. That is, it may be that the legislature enacted particular mandates in their state because they were already commonly offered by large employers in the state or because residents of the state were perceived to benefit from the coverage.

Wage And Benefit Adjustments To Mandates

If mandates are costly, their inclusion in employer-sponsored health insurance plans should lead to reductions in wages or other forms of compensation. This adjustment in the compensation bundle is referred to as ‘compensating differentials.’ There is one particularly strong analysis relating to state insurance mandates. In the mid-1990s, 23 states enacted legislation requiring that maternity services be included as a covered benefit in employer-sponsored health insurance. Gruber (1994a) examined the effects of the enactment of this law in Illinois, New York, and New Jersey compared to five states that had not enacted the legislation. His approach was to compare: the hourly wages of affected people to those unaffected, in states that enacted the law to those that did not, in the periods before and after the date of enactment. Affected people were employed married women aged 20–40 years, that is, those potentially likely to use the new benefit. Unaffected people were defined as employed single men aged 20–40 years and all employed people aged 40–60 years.

This is the so-called triple-differences model. Gruber’s work is increasingly the standard approach to addressing the effects of insurance mandates. Its strength is that it controls for trends occurring over the period before and after the enactment, for differences in the states enacting and not enacting the laws, and for differences that might exist in the average productivity of people affected and not affected by the law. Gruber found that the net effect of the maternity mandate was to reduce the average hourly wages of the affected group, in the enacting states after passage of the law by 5.4% relative to unaffected groups in nonenacting states over the same period. This amount was consistent with the actuarial estimates of the cost of the coverage. This is very strong evidence that the effect of a binding mandated benefit law is to reduce other elements of the compensation bundle. In short, it implies that workers pay for much of the cost of a mandate.

Self-Insured Plans: Avoiding Mandates

The 1974 federal ERISA legislation exempts self-insured firms from state insurance regulation. One way to avoid the costs of unwanted health insurance mandates would be to obtain coverage through a self-insured plan. Virtually all large employers offer plans that are self-insured. Even a small employer could provide self-insured coverage; they would do so by buying stop-loss coverage (sometimes called reinsurance) that limits their liability once claims in total or for individual cases reach a specified threshold. Nearly 60% of insured workers were in self-insured plans in 2009.

The empirical work on the relationship between state mandates and the propensity to self-insure comes from the late 1980s and early 1990s. Jensen et al. (1995) examined the effects of costly mandates and other factors on the switch from conventional to self-insured coverage in the 1981–84 and 1984–87 periods. Most mandates had a positive but statistically insignificant effect on the self-insurance decision. They did find that state premium taxes and high risk pool taxes were strongly associated with switching. Subsequent work found no consistent effects of mandates on the self-insurance decision and some suggestion that self-insured status was associated with firms that had multiple locations and who may have been trying to avoid conflicting state regulation.

Mandates And Coverage Decisions

Jensen and Gabel (1992) were among the first to estimate the effect of state insurance mandates on the probability that an employer would offer insurance coverage. Using 1985 data from small employers they concluded that every additional mandate in a state reduced the probability that a firm would offer coverage by 1.5%. Surprisingly, they also found that some arguably high cost mandates such as alcohol and drug abuse treatment and continuation of coverage requirements had no statistically significant effects. Gruber (1994b) examined the effects of five costly mandates: alcoholism treatment, drug abuse treatment, mental illness, chiropractic services, and continuation of coverage using Current Population Survey (CPS) data from 1979, 1983, and 1988. He found no effects of the mandates on the probability of having coverage.

Sloan and Conover (1998) examined data from 1989 to 1994 CPS. They measured regulation as a count of the number of state mandates in effect and concluded that eliminating state mandates would reduce the number of uninsured in the state by 20% and 25%. In a recent working paper Ma (2007) updated these analyses using the 1996–2002 CPS. His focus was on two alternative sets of high cost mandates and unlike the earlier studies in this section he used state and year differences-indifferences to control for contemporaneous trends in coverage and systematic differences across states. He found no statistically significant effects of mandates on coverage decisions.

This set of work highlights two crucial problems that have tended to undermine much of the work that has looked broadly at the effects of state mandates. First, state laws differ markedly with respect to the likely costs they impose on potential purchasers and the nature of the coverage that they actually mandate. The research has been rather cavalier with measuring regulation. Efforts to aggregate state laws via counts of laws, for example, at best can only obtain an average effect of an average mandate. It seems increasingly clear that there is as yet no good empirical way to look at the overall effects of state mandates. One must look at the effects of mandates individually and provide some assurance that the laws under study are homogeneous. Second, state insurance mandates are not enacted randomly. They result from legislative actions that in turn reflect issues such as resident preferences, existing levels of coverage, and the influence of providers. Failure to account for the endogeneity of the laws is almost certainly responsible for much of the inconsistency and uncertainty surrounding a lot of the existing empirical work.

The New Generation Of Mandates Research

Several mandate-specific studies have been undertaken in the past decade. They focus on the careful measurement of a particular mandate across the states and they rigorously deal with the endogeneity issue by using differences-in-differences (or sometimes triple differences) or instrumental variables. These studies have not uniformly concluded that the laws have affected use or outcomes. However, they have given much greater attention to measuring the law and they employ much more sophisticated methods to account for the endogeneity of the legislation. Several examples are noteworthy.

Bitler and Carpenter (2011) examined the effects of mammography screening mandates. They used person-level data from the Behavioral Risk Factor Surveillance System (BRFSS) over the 1987–2000 period and concluded that the mandates account for approximately 7% of the doubling of screening observed over the study period. This conclusion resulted from a triple-difference analysis that compared screening in states that did and did not enact the mandate, before and after enactment, among women at ages that were and were not recommended for screening.

Klick and Stratmann (2007) used the 1996–2000 BRFSS data to examine the effects of mandates that cover diabetes supplies, treatment, and services on obesity among diabetics. They too used the triple-difference model (states that did and did not enact the mandate, before and after enactment, and for those with and without a self-reported diagnosis of diabetes). Their hypothesis was that the presence of the mandate lowered the cost of treatment and, therefore, provided incentives for individuals to let their health deteriorate. They conclude that diabetics in states that enacted the coverage mandates, had greater increases in body mass index (BMI) compared to changes in BMI for nondiabetics in states without mandates over the same period. They also found that the results depended on the use of the triple-difference approach. Less rigorous models suggest that the mandates lowered BMI. In related work also focusing on the moral hazard effects of insurance mandates, Klick and Stratmann (2006) examined the effects of mental health mandates (that included substance abuse treatment) on the per capita consumption of beer in the state. They argue that the mandate lowers the cost of alcohol abuse treatment, should it be needed. They explicitly model the enactment of the law using the enactment of medical malpractice damage caps, diabetes mandates, and the number of nonpsychiatrist physicians per capita as instruments. Their estimates suggest that the mandate enactment was associated with an additional consumption of two cases of beer per capita.

In less controversial work, Liu et al. (2004) examined the effect of the so-called drive-by delivery laws. These provisions were enacted to prevent insurers from insisting that women and newborns be discharged from a hospital too quickly after a birth. The researchers used hospital discharge abstract data from 18 states over the period 1995–98. Their differences-indifferences analysis concluded that the laws resulted in 11% longer lengths of stay for vaginally delivered newborns. The effects were larger when the law was a ‘mother’s decision’ rather than specifying a ‘physician decision.’ The effects were smaller among patients who were likely to be exempt from the law due to ERISA.

Summary

State insurance mandates have proliferated since the mid- 1970s. The economics of the laws suggest that they should increase insurance premiums, reduce coverage, and lead to greater self-insured status among employers. More generally, they may affect the use and outcomes of mandated services and may influence the take-up of health insurance. The empirical work has been inconsistent in its findings. This stems from measurement issues in classifying and aggregating the laws and a failure to account for the nonrandom enactment of laws in the states. The new generation of research, largely undertaken in the 2000s and building on Gruber’s (1994b) seminal work on maternity mandates, has used much more sophisticated techniques and provided much greater confidence in the evaluations of how the laws have affected behavior.

References:

- Acs, G., Winterbottom, C. and Zedlewski, S. (1992). Employers’ payroll and insurances costs: Implications for play or pay employer mandates. In Health benefits and the workforce, pp. 195–230. Washington, DC: U.S. Department of Labor, Pension and Welfare Benefits Administration.

- Bitler, M. P. and Carpenter, C. (2011). Insurance mandates and mammography. National Bureau of Economic Research Working Paper 16669. Cambridge, MA: National Bureau of Economic Research.

- Bunce, V. C. and Wieske, J. P. (2010). Health insurance mandates in the states 2010. Alexandra, VA: Council for Affordable Health Insurance. Available at: http://www.cahi.org/cahi_contents/newsroom/article.aspid=1036 (accessed 06.06.13).

- Gruber, J. (1994a). The incidence of mandated maternity benefits. American Economic Review 84, 622–641.

- Gruber, J. (1994b). State mandated benefits and employer provided health insurance. Journal of Public Economics 55, 433–464.

- Jensen, G. A., Cotter, K. D. and Morrisey, M. A. (1995). State insurance regulation and an employer’s decision to self-insure. Journal of Risk and Insurance 62, 185–213.

- Jenson, G. A. and Gabel, J. (1992). State mandated benefits and the small firm’s decision to offer health insurance. Journal of Regulatory Economics 4, 379–404.

- Jensen, G. A. and Morrisey, M. A. (1999). Employer-sponsored health insurance and mandated benefit laws. Milbank Quarterly 77(4), 425–459.

- Klick, J. and Stratmann, T. (2006). Subsidizing addiction: Do state health insurance mandates increase alcohol consumption? Journal of Legal Studies 35, 175–198.

- Klick, J. and Stratmann, T. (2007). Diabetes treatments and moral hazard. Journal of Law and Economics 50, 519–538.

- Kominski, G. F., Ripps, J. C., Laugesen, M. J., Cosway, R. G. and Pourat, N. (2006). The California cost and coverage model: Analyses of the financial impacts of benefit mandates for the California legislature. Health Services Research 41(3 Part II), 1027–1044.

- Laugesen, M. J., Paul, R. R., Luft, H. S., Aubry, W. and Ganiats, T. G. (2006). A comparative analysis of mandated benefit laws, 1949–2002. Health Services Research 41(3 Part II), 1081–1103.

- Liu, Z. W. H., Dow and Norton, E. C. (2004). Effect of drive-through delivery laws on postpartum length of stay and hospital charges. Journal of Health Economics 23(1), 129–156.

- Ma, A. (2007). Another look at the effect of state mandates for health insurance benefits. Working Paper. Philadelphia, PA: Wharton Research Scholars Journal, University of Pennsylvania.

- Sloan, F. A. and Conover, C. J. (1998). Effects of state reforms on health insurance coverage of adults. Inquiry 35(3), 280–293.