Long-term care is a sector of the healthcare industry that is growing in importance with the aging of populations around the world. In the United States, according to the Congressional Budget Office, expenditures on long-term care totaled US$135 billion in 2004 and are expected to double in several decades. People with long-term care needs generally have chronic conditions and associated functional and/or cognitive limitations that require assistance with activities of daily living (bathing, dressing, toileting, transferring, eating) or instrumental activities of daily living (housekeeping, using a telephone, shopping, preparing meals, money management). These types of needs can be served in a variety of settings: in the home (formally by paid home care or informally by family and friends), in a nursing home, in an assisted living facility, or in an adult day care center, among others. Although the lines between acute care, postacute care, and long-term care have become blurred for long-term care recipients as more and more high-tech services formerly provided only in hospitals are now administered in a variety of settings, an ongoing need for assistance with functional or cognitive limitations remains the defining feature of an individual with long-term care needs. Although some recipients of long-term care are under the age of 65, the majority are elderly.

Long-term care is growing in importance not only due to demographic shifts but also due to the emergence of chronic conditions as a primary healthcare challenge. Much of the developed and parts of the developing world, having experienced both the eradication of many infectious diseases and the benefit of technological advances that lessen the mortality from the largest causes of death in earlier eras, are now struggling with a growing prevalence of chronic health conditions, sometimes exacerbated by poor health behaviors. These are often costly conditions that require ongoing care over many years, and failure to access appropriate chronic care can lead to a greater need for acute care. Nonetheless, payment systems have generally not adapted to the growing importance of chronic conditions and associated long-term care needs. In the United States, Medicare, the publicly run health insurance system for the elderly, was designed to cover temporary acute care and explicitly disavows responsibility for covering long- term care. Medicaid, designed to cover healthcare needs of the poor, has by default become the dominant public payer in long-term care (approximately two-thirds of nursing home residents at any given point in time are on Medicaid), but as this was not the original intent of the program, substantial gaps and inefficiencies remain. In addition to lack of recognition or foresight about the growing financial burden of long-term care, many societies express some ambivalence about who should be responsible for long-term care, as much of it is relatively low-tech and can potentially be provided by family members. The resulting lack of intentional and systematic financing is a key feature of the economics of the long- term care sector that distinguishes it from other healthcare sectors involving the elderly and sets the stage for a private long-term care insurance market.

Developed nations around the world face similar situations in terms of demographic change and a growing need for long-term care that was not entirely recognized or anticipated when coverage for acute care needs was evolving. Depending on their resources, cultural norms, ideology, and existing healthcare delivery and payment infrastructure, countries have followed a variety of approaches to covering long-term care. Several have opted for national long-term care insurance systems (e.g., Germany, Japan); others have incorporated some long-term care services, especially home and community-based services, into existing social insurance programs (e.g., Denmark); and some rely on a combination of self-funding, private long-term care insurance, and a safety net of public funding as a payer of last resort (e.g., the United States). Countries that rely mainly on private financing – or would like to ease the burden on public coffers – have a stake and interest in the existence and survival of private long-term care insurance markets.

The risk of needing long-term care is, in theory, an appropriate risk to be insured against. The average probability among aging individuals of needing long-term care is not trivial and is associated with substantial and unevenly distributed cost, but which individuals will experience the highest costs is seemingly random when viewed at the typical age of insurance purchase (50–65). On average, individuals turning 65 will need some type of long-term care for 3 years, but half will have no private out-of-pocket expenditures, due to lack of either need or the availability of informal care to meet low-level needs. However, more than 1 in 20 is projected to spend more than US$100 000 out of pocket in 2005 (Kemper et al., 2005). According to MetLife Mature Market Institute (2008), nursing home care costs more than US$70 000 per year on average, which implies that only a small minority of individuals can finance an extended stay out of pocket. The skewed distribution of uncertain costs associated with long-term care is a feature that would normally bode well for a robust insurance market.

Despite the conceptual appropriateness of a robust long- term care insurance market, only approximately 13% of the elderly population in the United States reports having long- term care insurance. Most policies are purchased on the individual-payer market, as group long-term care insurance policies are relatively rare. Benefit eligibility is usually triggered with medical certification of a minimal level of functional dependence, defined as assistance needed with activities of daily living. The vast majority of policies cover home care as well as nursing home care for a given number of years, but benefits are generally paid as a set per diem amount to be applied toward a given service as opposed to covering the total cost of the service. Many policies adjust benefits for inflation over time. Policies typically cost several thousand dollars per year, but costs can range substantially depending on age and health status. Individuals who exhibit signs of existing or imminent long-term care need (e.g., those who already have mild cognitive or functional impairment) are generally ineligible for policies at any price. Long-term care insurers are generally not allowed to raise premiums over time for an individual whose health risk increases, but they can adjust for changes in risk for an entire class of policyholders if payouts are higher than expected. Individuals who fail to pay premiums (policy lapse) forfeit all benefits and all premiums paid previously; few policies to date have built in nonforfeiture benefits that would allow individuals to recoup some of the investment in a lapsed policy. Most state insurance regulations include safeguards that help to avoid unintentional lapse.

Theory Of Demand For Long-Term Care Insurance

Economists have generally modeled the behavior of consumers in the decision to purchase insurance using a standard expected utility framework; i.e., insurance will be purchased if expected utility with insurance is greater than without insurance. The theoretical underpinnings of long-term care insurance differ from these standard theories of insurance purchase mainly due to the role of family and bequests. That is, when consumers consider purchasing insurance against the risk of long-term care costs, they consider not only the direct expected utility of smoothing consumption but also the utility elicited through the behavior of a spouse or children and the altruistic utility derived from leaving a bequest to heirs.

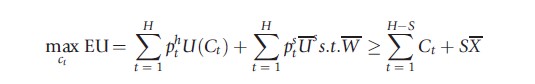

The prominent theoretical model in this area is Pauly (1990), with an extension by Zweifel and Struewe (1998). Assuming imperfect annuity markets, Pauly considers expected utility optimization under several scenarios: single elderly with no children and no bequest motive, with differential quality, and with adult children and a possible bequest motive. Expected utility in the presence of a spouse is also discussed briefly. The model is aimed at explaining purchase (or nonpurchase) of long-term care insurance among middle-income individuals, as nonpurchase is obvious among very poor individuals likely to qualify for Medicaid and among richer individuals who can easily self-insure. The expected lifetime utility function (EU) to be maximized is given as

where H is the maximum length of life, pht is the probability of surviving to period t in the healthy state and pst in the sick state (in need of long-term care), C is dollars of consumption, and U s is the level of utility if one is in need of long-term care and consuming X dollars worth of care, the only type of desired consumption in the sick state. W represents initial wealth, which is assumed to be substantially larger than SX such that the individual initially has enough wealth to pay his or her maximum long-term care costs and is unlikely to qualify for Medicaid. Individuals choose C to maximize expected utility.

The model under each scenario predicts that the low demand for long-term care insurance may be rational. The case in which single elderly individuals have no children and no bequest motive is straightforward given the assumptions of the model. Because Medicaid exists as a safety net when wealth is exhausted, the only benefit to purchase of long-term care insurance is to increase consumption in the sick state, the marginal benefit of which is defined to be zero. Although this assumption is restrictive, one might imagine that the marginal benefit of additional consumption while in need of nursing home care is at least low if not zero, in which case the same conclusion would result.

The case in which private insurance enables access to higher quality nursing home care than that obtained under Medicaid funding is a realistic one in that nursing homes with large Medicaid populations are generally considered to be of lower quality. Thus, one might expect middle-class individuals to purchase long-term care insurance if they value quality. However, Pauly argues that this would rarely be the case because one cannot pay an incremental premium to purchase an incremental quality supplement to Medicaid. Rather, the purchase of private insurance replaces Medicaid. Thus, a consumer would have to value the incremental quality of a privately financed nursing home over and above a Medicaidfinanced nursing home stay enough to outweigh the additional cost of foregoing Medicaid completely and paying private long-term care insurance premiums. Relatively few individuals are likely to have this high valuation for incremental quality.

A similar argument applies to the case in which bequests are valued, i.e., the individual receives utility from leaving wealth to his or her heirs. One would expect that valuing bequests would lead to a higher propensity to purchase long- term care insurance, as private insurance for nursing home care allows an individual to retain wealth in the sick state in contrast to relying on Medicaid, which requires the exhaustion of one’s wealth before coverage begins. However, the value of bequests would have to be quite large in order to lead to purchase, for two reasons. First, purchase of insurance decreases consumption not only at time t but also in the future if the person remains in a healthy state, so additional savings may provide greater utility than insurance purchase when bequests are valued. Second, although insurance may be preferable to savings if the individual lives a long time with chronic illness, this scenario is unlikely because chronic illness is generally associated with earlier mortality. Thus, even if bequests are valued, purchase is unlikely unless the utility from bequests is high and does not decline sharply with age.

The bequest argument is more complicated when a spouse is involved rather than just adult children. In this case, Pauly argues that both household consumption and income may be affected if one spouse enters a nursing home, depending on the extent to which these are joint. Demand for long-term care insurance may be relatively high if consumption of the nonsick spouse is substantially affected by the nursing home stay of the sick spouse.

Finally, perhaps the most important contribution of Pauly’s paper is the introduction of intrafamily bargaining into the conceptualization of demand for long-term care insurance, drawing on earlier work in the bequest literature, which posited that parents use bequests to elicit desired attention or caregiving from children. Pauly modifies this premise somewhat to argue that, once in the sick state, parents will have little control over consumption or bequests, such that parents choose whether to purchase insurance in the healthy state but that children control the level of care in the sick state. Parents may prefer care from children and may want to purchase long-term care insurance to preserve bequests that the parent values altruistically and with which to elicit caregiving behavior on the part of children. However, as children decide on the level of care in the sick state, children are subject to moral hazard associated with the presence of insurance. That is, children will choose more formal care (nursing home placement) in the presence of insurance than what the parent would prefer because the price they face is lower than in the absence of insurance. Anticipating this moral hazard effect on the caregiving behavior of children, the parent may be better-off not purchasing insurance and getting the higher level of care from children.

Zweifel and Struewe (1998) formalize this intrafamily bargaining argument using a principal-agent framework and a two-generation model that is independent of assumptions about altruism. The elderly parent chooses consumption and whether or not to purchase long-term care insurance to maximize expected utility, and the amount of care provided by children is an argument in the utility function in the sick state. The child maximizes his or her own expected utility, choosing consumption and the amount of care to provide if the parent enters the sick state. By providing care, the child is presumed to forego work in the labor force but also to expect a higher bequest, as less will be spent by the parent on formal long-term care. Zweifel and Struewe show that, under these circumstances, the child’s response to purchase of long-term care insurance depends heavily on the child’s wage rate. At low wages, where one might expect the most caregiving, the presence of insurance is most likely to produce a moral hazard effect. Anticipating this response, purchase of long-term care insurance is often not in the best interest of parents who desire caregiving by their low-wage children, for the same reasons that Pauly posited.

The Pauly model is general and intuitive in many respects, explaining its pervasive use and longevity in the study of long-term care insurance. However, it has some limitations and may be dated in some ways. First, it does not formally model joint decision-making with a spouse, one of the most common scenarios among potential purchasers. Second, it is assumed that parents prefer care from children, which may be an outdated notion for many families. Preference may depend importantly on the severity and type of long-term care needs, on the relationship between the parent and the child, and on the extent to which a parent prefers to stay independent and not burden the child. Third, Pauly models long-term care insurance as only nursing home insurance, whereas the vast majority of long-term care insurance policies now cover home care and other community-based options as well as nursing home care. Home care is generally considered much more desirable than nursing home care, so more parents may prefer it to informal care, and it may entail a completely different set of family dynamics; for example, informal care may be a complement to formal home care rather than a substitute for it. Thus, there exists a need for updated theoretical models of the demand for long-term care insurance that consider these factors.

Theory Of Supply Of Long-Term Care Insurance

Research on long-term care insurance to date has focused largely on the demand side, with relatively little theoretical or empirical work on the supply side. As in other insurance markets, insurers consider the potential for adverse selection and moral hazard in deciding whether to offer a product, at what price, and with what attributes. One of the few papers to consider this perspective is Cutler (1993), which discusses both adverse selection and moral hazard as important potential market failures in long-term care insurance markets. Adverse selection may be a more serious concern in long-term care insurance than in acute health insurance because the elderly and near-elderly population is naturally more heterogeneous in health status than a younger population, and this heterogeneity may not be observable to insurers. Thus, there is greater potential in this population for the existence and use of private information leading to a sicker risk pool than anticipated by insurers when setting price. Cutler also raises the issue of long-term intertemporal risk. In other types of health insurance in which premiums are set annually, prices can be reconciled with unanticipated trends in claims and provider prices fairly quickly. In long-term care insurance, however, because the event being insured today may not occur for another 20 years, insurers face the risk of rising prices over time that cannot be diversified across a risk pool. Thus, insurers generally shift this risk to consumers. Fears about the extent of adverse selection and moral hazard, coupled with this intertemporal risk and a lack of claims experience for this relatively new product, has led to strict underwriting, indemnity policies, high administrative loads, and consequently ‘expensive’ premiums that may not seem affordable or of good value to many potential purchasers.

Distinctive Features Of The Long-Term Care Insurance Market And Related Empirical Evidence

Long-term care insurance has several key features distinguishing it from acute care insurance: the role of the family (especially adult children), low prevalence of insurance, and greater concern about adverse selection. A relatively small but growing body of empirical work on long-term care insurance reflects these features and can be broadly categorized into research on intrafamily decision-making, price and other determinants of purchase and nonpurchase (including Medicaid crowd-out), and adverse selection. As a whole, the evidence is consistent on a few aspects of this market – for example, that Medicaid crowd-out exists – but on other aspects, the evidence is often sparse, inconsistent, incomplete, and inconclusive. Each of these categories is discussed below, followed by a discussion of the remaining theoretical and empirical gaps.

Intrafamily Decision-Making

As established by Pauly, the role of families in decision-making, insurance purchase, and provision of long-term care is a feature of the long-term care insurance market that distinguishes it from other types of health insurance. However, empirical research has not been able to substantiate the contention in Pauly’s model that children will be more likely to institutionalize parents in the presence of insurance, a key premise underlying the rational nonpurchase of long-term care insurance among parents with adult children. The main study to address this issue (Mellor, 2001) used Health and Retirement Study (HRS) data in a longitudinal study design; the HRS is one of the few national data sets to include questions on long-term care insurance and is used in the vast majority of studies noted in this article. Mellor found point estimates generally in the expected direction – institutional long-term care use was more likely in the presence of insurance – and with potentially meaningful magnitudes, but the results lacked statistical significance. However, the study used a measure of insurance from the early years of HRS that was later shown to be subject to measurement error and included a shorter panel of data than is now available, limiting power. Thus, current evidence cannot establish conclusively how the presence and preference of adult children impact long-term care insurance purchase and subsequent long-term care provision, and the need for further research remains.

Evidence on the role of family in long-term care insurance and provision is also tied to the bequest literature, as the desire to leave a bequest to one’s heirs has often been posited as a potential motivator for long-term care insurance purchase. If a bequest is desired, one might think of long-term care insurance as bequest insurance, because in the absence of insurance, one’s saving may be needed for long-term care costs, thus reducing or eliminating the prospect of a bequest. Early empirical evidence using direct queries about the desire to leave a bequest found no support for such a bequest motive in insurance purchase decisions (Sloan and Norton, 1997). A recent working paper, however, looks indirectly at long-term care insurance purchase to distinguish precautionary savings motives from bequest motives in savings behavior late in life (Lockwood). The main premise is that a precautionary savings motive is consistent with purchase of long-term care insurance, as the underlying goal would be to ensure availability of resources for healthcare needs. Low levels of long-term care insurance purchase are therefore indicative of a strong bequest motive in savings behavior, as the precautionary savings motive is ruled out. The author reconciles the strong bequest motive with low levels of long-term care insurance by suggesting that insuring the bequest is not valuable enough to justify the purchase of currently available long-term care insurance policies. This may explain the apparent lack of support for the bequest motive found in earlier studies.

Determinants Of Purchase And Nonpurchase

Compared with acute care health insurance, the demand for which is generally thought to be a function of health, income, price, and risk aversion, the demand for long-term care insurance appears to be more complicated. The low prevalence of long-term care insurance has engendered numerous studies of why people do or do not purchase it. Evidence on private long- term care insurance (LTCL) prevalence suggests that among the elderly and near-elderly, the younger, healthier, and more educated people are more likely to have LTCI, and that there is some relationship, most likely nonlinear, between purchase of LTCI and income and assets. Although those in the lowest income and asset groups are not likely to purchase LTCI because it is expensive (generally several thousand dollars per year) and because they face a lower ‘price’ of Medicaid in terms of spending down assets to qualify, those in the highest income and asset groups may also not purchase insurance because they can self-insure. Therefore, it is often the ‘middle’ income and asset groups that are the most likely purchasers. Earlier studies cited Medicaid crowd-out, underestimation of risk, and the presence of adult children or bequest motives as potential reasons for nonpurchase but found mixed or inconclusive empirical results. Norton (2000) provides a useful summary of these arguments and the earlier evidence on purchase and nonpurchase. Many of these studies were limited by reliance on cross-sectional analyses, which precludes the establishment of a causal link between the predictors and the outcome.

More recent studies have taken advantage of exogenous variation in Medicaid policy and state and federal tax policies to move toward causal inference in estimating the demand for long-term care insurance and specifically to examine the issue of Medicaid crowd-out, i.e., the substitution of private insurance for public insurance when public insurance exists. Because Medicaid has become a primary payer of long-term care services, both in nursing homes and in the community, crowdout is a potential obstacle to any expansion of the private long-term care insurance market. These recent studies generally find that Medicaid crowd-out is substantial and suggest that even a tightening of Medicaid eligibility rules would not be effective in mitigating crowd-out. Brown and Finkelstein (2008) argue, using a utility-based model and simulation, that Medicaid crowd-out can explain nonpurchase of long-term care insurance for at least two-thirds of the wealth distribution. The large crowd-out effect stems from the large ‘implicit tax’ that Medicaid imposes on private insurance benefits in that the majority of private insurance benefits go toward covering services that Medicaid would have paid in the absence of private insurance. Thus, consistent with Pauly’s reasoning, the value of a private policy to consumers is incremental whereas the premium derived from the total package of benefits is not. Although one might argue with the extent of the income distribution that is potentially affected, the existence of some degree of crowd-out is a reasonable conclusion. As Medicaid is generally incomplete insurance relative to private coverage, Medicaid crowd-out of private long-term care insurance may increase the overall risk exposure of the population.

It has often been posited that supply-side market failures contribute to low demand for long-term care insurance because these market failures result in undesirable policy attributes and a perception by consumers that the policies are not of good value. Value of an insurance product may be perceived as low if the administrative load is high, i.e., if the discounted expected present value of premiums far exceeds the discounted expected present value of benefits. In turn, concerns about substantial adverse selection, moral hazard, and, in the case of long-term care insurance, undiversifiable intertemporal risk may contribute to high administrative loads; these are the market failures. Brown and Finkelstein (2007) calculate that the average administrative load on long-term care insurance is 51%, substantially higher than loads estimated in other private insurance markets. This estimate includes the probability of lapse, in which case consumers generally forfeit all benefits. However, the authors also argue that despite these high loads, supply-side factors cannot explain the majority of nonpurchase of long- term care insurance. The argument is based mainly on the fact that administrative loads vary substantially by gender, with women facing much lower loads, yet women still do not purchase long-term care insurance at much higher rates than men. Thus, it is demand rather than supply that drives the behavior. In particular, the effect of Medicaid crowd-out is possibly much stronger than the effect of supply-side attributes.

Several studies have attempted to estimate a price elasticity of demand for private long-term care insurance. Cramer and Jensen (2006) combined HRS data with estimated prices derived from published rate schedules of several major insurers to calculate an estimated price elasticity of –0.23 to –0.87, indicating that new purchase of long-term care insurance is relatively price inelastic. Courtemanche and He (2009) also used HRS data, but derived an exogenous change in price using a change in federal tax treatment of long-term care insurance (new eligibility of long-term care insurance premiums to be deductable as a medical expense under the Health Insurance Portability and Accountability Act of 1996) combined with marginal income tax rates. They found a price elasticity of –3.9, indicating that purchase of long-term care insurance is highly elastic. These disparate results may perhaps be explained by the fact that identification was derived from different parts of the income spectrum, but in any case, the need for further research in estimating the determinants and elasticities of demand remains.

Adverse Selection

The potential for adverse selection is a concern for insurers of any type of event. Under adverse selection, potential purchasers have more information about their own risk than what is available to insurers and use this private information to assess the value of a policy. Because premiums do not account for the private information, riskier individuals are more likely to find the policy of value than less risky individuals, with the result that the pool of actual purchasers is riskier than what insurers would expect given an actuarially fair premium – a situation that is not sustainable in the long run. The potential for adverse selection is arguably greater in long-term care insurance than in other types of healthcare insurance for several reasons. First, the typical purchaser of long-term care insurance is elderly or near-elderly, and health states become more heterogeneous with age. Thus, the potential for private information about one’s health risk is greater in an elderly population than in younger populations. Second, the market for long-term care insurance is small and largely based on individual policies rather than group policies. Thus, the broad diversification that can be achieved through, for example, employer-based group health insurance is not currently possible in long-term care insurance. In the one rigorous and broad-based study of this issue, Finkelstein and McGarry (2006) find empirical evidence in the HRS for this type of adverse selection in that individuals with private information that they are at high risk are more likely to purchase long-term care insurance. However, they find that it is balanced by favorable selection into insurance by individuals who have private information that they are more risk averse (but healthier). Thus, although adverse selection exists in long-term care insurance, the overall insured pool is not sicker than what insurers expect when calculating premiums.

The emergence of personalized medicine and genetic testing has led to increasing interest in genetic adverse selection. The availability of genetic tests for several serious diseases associated with long-term care needs makes this an especially salient issue for the long-term care insurance market, and the small size and individual-payer nature of the market has proved to be useful in studying this type of adverse selection. Recent evidence finds that, not surprisingly, people found to be at genetic risk for Huntington’s disease or Alzheimer’s disease are much more likely to purchase or to plan to purchase long-term care insurance than others – 2.3 times as likely in the case of Alzheimer’s disease (Taylor et al., 2010) and five times as likely in the case of Huntington’s disease (Oster et al., 2010). Although the absolute prevalence of these genetic markers in the population is small, this evidence provides a challenge not only for insurers but also for policymakers interested in balancing privacy rights against the need for a sustainable insurance market.

A related issue to adverse selection at the time of purchase is that of dynamic adverse selection. Because long-term care insurers are generally not allowed to raise premiums over time for an individual whose health risk increases, one can conceptualize purchase of long-term care insurance as insurance against reclassification into a higher risk category, much as in life insurance markets. In theory, if premiums are actuarially fair when purchased but are paid over time, individuals may decide to drop insurance (lapse) if their risk ex post appears lower in later years than when they bought the policy. Lapse thereby becomes a mechanism for ex post adverse selection, a dynamic inefficiency in the insurance market that puts upward pressure on premiums for those remaining in the risk pool. Finkelstein et al. (2005) examine this issue in long-term care insurance markets, conceptualizing lapse as a rational response to a reevaluation of health risk. Empirically, the authors find that respondents who have ‘ever let a LTCI policy lapse’ are less likely to have a nursing home stay within 5 years than similar respondents who bought and kept policies, providing support for their hypothesis that lapse represents ex post adverse selection. However, the results may also be explained by a moral hazard effect. Using more years of data and testing for a broader variety of covered services and health status measures not subject to moral hazard, Konetzka and Luo (2011) find that lapse is driven more by financial reasons than health-related reasons, resulting in a healthier insured pool remaining. Individuals who lapse are generally poorer, less educated, less healthy, and more likely to be racial and ethnic minorities than those who retain their policies. Thus, although ex post adverse selection may occur for some groups of purchasers, it is not a primary driver of lapse and lapse as a whole is unlikely to affect the risk pool adversely. In addition, lapse rates are generally considered low in long-term care insurance relative to other insurance markets.

Given the aging of the population and the associated need for solid theory and evidence to inform public policy, the need for further research on long-term care insurance markets is great. Because long-term care insurance is different in marked ways from acute care health insurance, lessons learned in those markets may not be transferrable. To date, however, the theoretical foundation and empirical evidence on purchase and retention of long-term care insurance policies is far from complete. Although a growing body of evidence supports the existence of some degree of Medicaid crowd-out, the other determinants of policy purchase and retention remain murky, and evidence on the extent and nature of adverse selection is sparse. Two areas in particular are in need of better theoretical understanding and empirical research. First, although the role of the spouse and extended family is central in long-term care issues, still very little is understood about how intrafamily decisions are made with respect to long-term care insurance purchase and long-term care utilization. More sophisticated modeling of joint decision-making about this issue is paramount. Second, the literature on private long-term care insurance largely ignores moral hazard. Clearly, insurance ownership is only one key attribute of the market. Equally important is how insured individuals behave once they become insured. The significance of moral hazard – the utilization of long-term care services that are due to the presence of insurance and that would not be purchased without insurance – parallels the significance of adverse selection. Both are important because they could alter the cost of the insurance and thus the amount of the payout relative to the premiums.

Public Policy And Long-Term Care Insurance

Because long-term care is arguably the largest uninsured healthcare risk facing the United States (and many other countries) but political support for additional public coverage has been weak, policymakers have long been interested in finding ways to expand the private long-term care insurance market. The most established and well-known program designed to encourage purchase is the Partnership for Long-Term Care program, a state-based program developed in the late 1980s and first implemented in California, Connecticut, Indiana, and New York. The Deficit Reduction Act of 1995 enabled expansion of the program to other states. Under this program, purchasers of private long-term care insurance policies that cover a given number of years of care are afforded some degree of asset protection if and when they turn to Medicaid after their private policy benefits are exhausted. (Normally, Medicaid requires that individuals ‘spend down’ the majority of their assets before qualifying for benefits.) The specific rules about the degree of asset protection vary from state to state, but the two main models include a dollar-for-dollar matching of the amount of maximum benefit purchased with the amount of assets protected and a total asset protection model, which requires the purchase of a fairly comprehensive policy in return for total asset protection under Medicaid. Although there have been no rigorous evaluations of the program in the economics literature, estimates of take-up and potential Medicaid savings have been fairly small, as most people who purchased policies would have bought them in the absence of the program. Policymakers therefore appear supportive of the program but do not expect large expansions of private long-term care insurance coverage as a result.

A second tactic employed by US policymakers in pursuit of expanded private coverage is tax breaks, both state and federal, designed to lower the effective purchase price of private long-term care insurance policies. The Health Insurance Portability and Accountability Act of 1996 allowed long-term care insurance premiums to be deductable as a medical expense in calculating federal income taxes, similar to treatment of other medical expenses and insurance. Courtemanche and He (2009) studied the effect of the federal tax change on purchase behavior and found that the tax deduction led to significantly higher probability of purchase, on the order of a 25% increase among those eligible for the tax break. However, that effect translates to only a small increase in coverage across all seniors. Furthermore, they found that the loss in revenue to the government exceeded the potential savings to Medicaid in long-term care costs, leading to a net revenue loss. Similarly, Goda (2011) examined the impact of state tax incentives on private long-term care insurance coverage and the resulting effect on Medicaid expenditures, finding that the average state tax subsidy raised coverage by 28% and that the lost tax revenue exceeded the savings to Medicaid. In both cases, the net revenue loss was attributable largely to the fact that the part of the wealth and income distribution that responds to the tax incentives is generally not the part that relies on Medicaid.

Perhaps the most significant US public policy on this issue to date was the Community Living Assistance Services and Supports (CLASS) Act, passed as part of the Patient Protection and Affordable Care Act of 2010 but subsequently repealed when it was found to be financially unviable. CLASS was intended to reduce the uninsured risk of substantial long-term care costs by establishing an entirely voluntary, privatepremium-funded, but publicly administered long-term care insurance program. By statute, individuals who paid premiums for a minimum of 5 years and were working for at least 3 of those years would have been potentially eligible for benefits if they stayed in the program and reached an appropriate level of need, levels that would be similar to eligibility triggers used in private long-term care insurance. It was designed to be an ‘opt-out’ system such that employers could choose to participate or not, but if they chose to participate, employees would be automatically enrolled with the option to drop out if they chose. The benefits would be worth at least US$50 per day and would be available for a variety of long-term care services, not just nursing homes, but the benefit would be tied in some way to long-term service use (as opposed to a pure cash benefit). Most of the details of the design of the program were left to the ‘discretion of the Secretary’ (of Health and Human Services), but key restrictive attributes were written into the statute, including a requirement that the program be financially self-sustaining with no taxpayer subsidies for 75 years. Given the minimal requirements for eligibility and voluntary nature of the program, serious concerns about the potential for adverse selection made it impossible to design a premium structure that would meet the sustainability requirement. It was also unclear how the existence of a program like CLASS would affect the private long-term care insurance market as it stands today, but the rise and demise of CLASS underscores the need to better understand the private long-term care insurance market and the role that it can play as public policy toward long-term care financing evolves.

Conclusion

Theories and empirical evidence drawn from other types of health insurance may not apply to private long-term care insurance, as long-term care is distinct in several key ways. Family members, especially spouses and adult children, are hypothesized to play significant roles in decisions about long-term care insurance, yet the empirical evidence on the role of family is remarkably inconsistent and sparse. The market is small relative to other types of health insurance, with only 12% of the elderly population in the US holding policies. However, other than Medicaid crowd-out, the evidence on why people purchase or do not purchase policies is fairly weak, and policy efforts to expand the market have not been very successful. Given the existence of Medicaid as a safety net payer and the ability of the upper end of the wealth and income distribution to self-insure, it may be that the current size of the private long-term care insurance market is somewhat of a steady state. If that is the case, then the potential for market failures such as adverse selection and moral hazard – already of more concern in long-term care insurance markets than in other health insurance markets – becomes more of a threat to the stability of the market. Increases in adverse selection through advances in technology such as genetic testing, for example, could have serious implications for the existence of the market if it remains small.

Economists have identified and focused on these distinct features of long-term care insurance in a growing body of work. But despite the importance for public policy of economic theory and empirical evidence on long-term care insurance, significant gaps remain in the understanding of this market. As states and nations struggle with strategies to reduce the substantial individual and public risk of long-term care costs associated with aging populations, it will become increasingly important to fill these gaps.

References:

- Brown, J. R. and Finkelstein, A. (2007). Why is the market for long-term care insurance so small? Journal of Public Economics 91(10), 1967–1991.

- Brown, J. R. and Finkelstein, A. (2008). The interaction of public and private insurance: Medicaid and the long-term care insurance market. American Economic Review 98(3), 1083–1102.

- Courtemanche, C. and He, D. F. (2009). Tax incentives and the decision to purchase long-term care insurance. Journal of Public Economics 93(1–2), 296–310.

- Cramer, A. T. and Jensen, G. A. (2006). Why don’t people buy long-term-care insurance? Journals of Gerontology, Series B: Psychological Sciences 61(4), S185–S193.

- Cutler, D. M. (1993). Why doesn’t the market fully insure long-term care? NBER Working Paper Series #4301. Available at: http://www.nber.org/papers/w4301 (accessed 28.08.13).

- Finkelstein, A. and McGarry, K. (2006). Multiple dimensions of private information: Evidence from the long-term care insurance market. American Economic Review 96(4), 938–958.

- Finkelstein, A., McGarry, K. and Sufi, A. (2005). Dynamic inefficiencies in insurance markets: Evidence from long-term care insurance. American Economic Review 95(2), 224–228.

- Goda, G. S. (2011). The impact of state tax subsidies for private long-term care insurance on coverage and Medicaid expenditures. Journal of Public Economics 95(7–8), 744–757.

- Kemper, K., Komisar, H. L. and Alecxih, L. (2005). Long-term care over an uncertain future: What can current retirees expect? Inquiry 42(4), 335–350.

- Konetzka, R. T. and Luo, Y. (2011). Explaining lapse in long-term care insurance markets. Health Economics 20(10), 1169–1183.

- Lockwood, L. (2010). The importance of bequest motives: Evidence from long-term care insurance and the pattern of saving. Working Paper. Available at: http:// www.aria.org/rts/proceedings/2011/Lockwood-BequestMotives.pdf (accessed 28.08.13).

- Mellor, J. M. (2001). Long-term care and nursing home coverage: Are adult children substitutes for insurance policies? Journal of Health Economics 20, 527–547.

- MetLife Mature Market Institute (2008). The MetLife market survey of nursing home & assisted living costs. Westport, CT: MetLife Mature Market Institute.

- Norton, E. C. (2000). Long-term care. In Cuyler, A. and Newhouse, J. (eds.) Handbook of health economics, vol. 1A, pp. 955–994. Amsterdam: Elsevier Science.

- Oster, S., Shoulson, I., Quaid, K. and Dorsey, E. R. (2010). Genetic adverse selection: Evidence from long-term care insurance and Huntington disease. Journal of Public Economics 94(11–12), 1041–1050.

- Pauly, M. V. (1990). The rational nonpurchase of long-term care insurance. Journal of Economic Perspectives 6(3), 3–21.

- Sloan, F. A. and Norton, E. C. (1997). Adverse selection, bequests, crowding out, and private demand for insurance: Evidence from the long-term care insurance market. Journal of Risk and Uncertainty 15, 201–219.

- Taylor, Jr., D. H., Cook-Deegan, R. M., Hiraki, S., et al. (2010). Genetic testing for Alzhemer’s and long-term care insurance. Health Affairs (Millwood) 29(1), 102–108.

- Zweifel, P. and Struewe, W. (1998). Long-term care insurance in a two-generation model. Journal of Risk and Insurance 65(1), 13–32.

- Brown, J. R., Coe N. B. and Finkelstein, A. (2007). Medicaid crowd-out of private long-term care insurance demand: evidence from the health and retirement survey. NBER Working Paper Series #10989. Available at: http://www.nber.org/ papers/w12536 (accessed 30.08.13).