Cost shifting exists when a hospital, physician group, or other provider raises prices for one set of buyers because it has lowered prices for some other buyer. The term has also been applied to managed care firms that are similarly said to have raised premiums for one set of purchasers because it had to lower premiums for some other set. Cost shifting is often confused with price discrimination. Health service providers commonly price discriminate; that is, they charge different prices from different payers. However, such differential pricing strategies are not evidence of cost shifting.

Cost shifting frequently enters into debates over government payment polices for Medicare and Medicaid and is prominent in health-care reform debates. Some have argued, for example, that efforts to reduce Medicare expenditures by lowering payments to hospitals under the Medicare Prospective Payment System or through the encouragement of Medicare managed care plans may save money for Medicare, but it will increase expenditures by private payers. This is said to occur because hospitals simply raise their prices to private insurers to make up the difference. Insurers, facing higher hospital prices, will then tell employers that they have to raise health insurance premiums because they are ‘being cost-shifted against’ by hospitals.

Analogously, proponents of health-care reform will often argue that systemwide reforms are needed because efforts to control government expenditures will simply increase private expenditures. It is argued that private payers should support coverage for the uninsured because the costs of the subsidy will be less than they appear because the hidden cost shift will be eliminated. Any piecemeal effort to control costs will ultimately be eroded by increases in costs for some other payer with the result that costs are not controlled. Subsidizing care for the uninsured and reforming the health-care system are important goals, but cost shifting is unlikely to be a serious component of the underlying economics.

The Economics Of Cost Shifting

Morrisey (1994) used the Frank Capra movie It’s a Wonderful Life as a vehicle to describe the economics of cost shifting. In the movie, Mr. Potter owned most of the town of Bedford Falls and he was the meanest man in town. He charged high rents on his apartments and high interest rates on loans from his bank. Suppose he also owned and operated Potter Hospital, the only hospital in town.

As a profit-maximizing old man, Potter would charge the most people would be willing to pay for each hospital day. He would determine the extra revenue and extra costs associated with each day of hospital care and produce the number of hospital days for which the extra revenue just equaled the extra costs. If he produced less, he was giving up profit he could have had; if he produced more, he would lose money because the extra cost was greater than the extra revenue.

Suppose Potter had two sets of hospital service buyers. The first set includes private purchasers who are willing to pay according to their downward-sloping demand curves. At lower prices they will buy more hospital days. The second set comprises government-sponsored patients who pay only the amount set by the government. They cannot pay more and the government will not pay less. To keep the story simple, suppose that each group of patients costs the same to treat and that marginal costs increase over the relevant range of output.

Potter faces two questions: first, should he provide any care to government-sponsored patients, and second, if so, what price should he charge private patients. The answers are straightforward business economics. The objective is to extract as much profit out of each market segment as possible. On the government side, he will admit patients until the extra revenue, the government fee, is just equal to the extra cost of care. On the private side, things are a bit more complicated. He can charge only a single price in this market. A lower price implies more units sold, but he can collect the lower price only from people who would have paid more. So Potter must find the price at which the extra revenue is just equal to the extra costs of treating these patients. And that extra revenue can be no lower than what he could get from a government-sponsored patient. The result of these calculations is that Potter will admit patients until the marginal revenue from private patients is equal to the marginal revenue from governmentsponsored patients and is equal to the marginal cost of care.

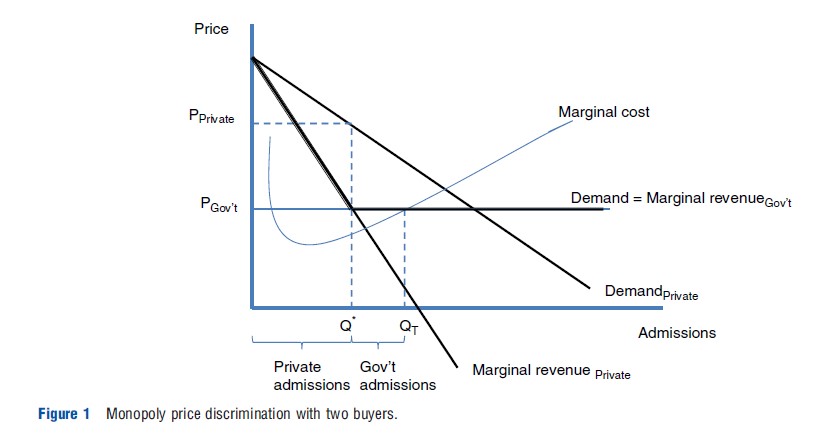

This is shown graphically in Figure 1. The analysis is a simple case of price discrimination on the part of a monopolist with two buyers. The government price (PGov’t) is fixed by government fiat and the hospital can get all the government patients it wants; thus, the government demand curve is also the government market marginal revenue. The private market yields a downward-sloping demand curve and its associated marginal revenue curve. The profit-maximizing hospital would (conceptually) trace out the envelope of the highest marginal revenue available from each market for every unit of service. This yields the kinked dark line that incorporates parts of each of the private and government marginal revenue lines in the figure.

Potter Hospital would produce hospital services to the point where marginal cost equals the envelope marginal revenue. That is, it would supply the quantity QT. Potter would sell the amount between Q* and QT to the government because the marginal revenue from the government is greater than that from the private market. He would sell the private market the quantity from the origin to Q* because over this range the marginal revenue from the private payers is greater than that offered by the government. Notice that, like a good monopolist, Potter charges the private market the most it will pay for the quantity up to Q* . That is shown by the private demand curve with the price PPrivate.

Thus, because he has market power, Potter can charge different prices to different purchasers. This is classic price discrimination. A firm with market power will charge different prices to different purchasers as long as the purchasers have different degrees of price sensitivity and as long as one group cannot resell to the other. Thus, Potter charges a higher price to private purchasers (who have less price sensitivity) and a lower price to government-sponsored buyers (who are not allowed to pay even a dollar more than the government rate). Similarly, airlines charge higher prices to those who have to travel on specific dates and lower prices to those who have flexible schedules.

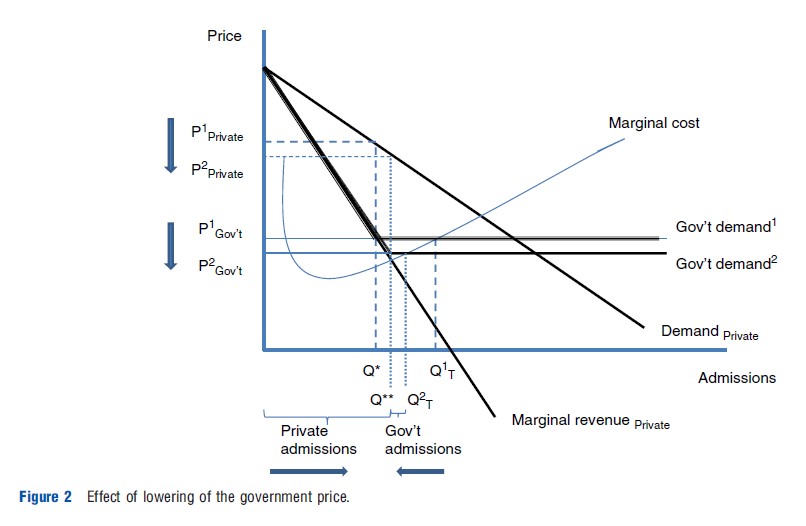

Now suppose the government lowers the price it will pay for hospital care. The cost-shifting argument says that Potter would accept the lower government price and ‘make it up’ by charging more in the private market. The economics imply the contrary. A lower government price signals that government patents are less profitable. Potter immediately sees that some private patients are willing to pay more than the new lower government rate. He shifts some hospital capacity to the private market. But to sell these services he has to lower the private price to everyone. Thus, government action lowering its price does not lead to higher private prices; rather lower private prices result as a profit-maximizing provider tries to shift capacity to the private segment of the market. Thus, standard theory indicates that cost shifting will not occur.

Graphically, the result is easily shown. See Figure 2, which adds a new lower government payment level to the earlier discussion. Note that the envelope of marginal revenue shifts down in its second segment. Potter Hospital reduces its total output from the old Q1T to Q2T to reflect the lower price avail- able. The smaller quantity is now reallocated with more going to private patients and less to government-sponsored patients. However, the only way that Potter can sell the extra private services is to lower the price, as the figure indicates, from P1Private to P2Private.

Suppose the hospital were nonprofit and therefore did not ‘maximize profits.’ To see this, consider George Bailey from the Wonderful Life movie. He has a good heart and wants to help people. Suppose he ran the hospital in Bedford Falls. In particular, suppose George wanted to have the newest technology and to provide care to the indigent who are not eligible for the government care and cannot pay for private care. Note that if these things paid, Mr. Potter would have provided them as well.

If the hospital is to be all it can be, George has to generate as much ‘surplus’ as he can. Surplus, of course, is just another word for profits. The business problem is exactly the same for George Bailey as it was for Mr. Potter. If the hospital wants to provide as much charity care and new technology as it can, it must charge what the traffic will bear in each of its markets. The only difference between the two is how they spend the ‘surplus.’ Thus, when the government cut its price, George would shift capacity to the private market segment and lower its price as well. Potter ended up with fewer profits, and George Bailey ended up being able to provide less charity care and less new technology. Again, no cost shifting is predicted.

Cost shifting requires that a hospital or provider, more generally, raises its price for the private patient when the government price is reduced. This result can be consistent with standard economics, but it requires some special circumstances. First, the provider has to have market power. Without it, it cannot charge different prices. Second, it has to ‘favor’ paying patients. This means it has to charge them prices that are below the profit-maximizing price. Another way to say this is that the provider has to have ‘unexploited market power.’ Some commentators have described nonprofit hospital boards as not permitting charges to be set at levels above that needed to provide quality. This could be construed as favoring paying patients with prices below ‘surplus maximizing’ levels.

Under this scenario the hospital could be thought of as spending surpluses it could have had on lower prices to paying patients. Then, when the government lowers its price, the hospital has less surplus to subsidize its paying patients and raises its private price. This is cost shifting as envisioned by its proponents.

Several hypotheses emerge from this analysis. First, market power is a necessary condition for cost shifting. If health-care markets are competitive, then cost shifting cannot exist because efforts to raise prices to one market segment would be thwarted by a willingness of others in the market to provide services at the old price.

Second, profit maximization implies no cost shifting. If a provider is indeed maximizing profits, by definition it has no unexploited market power. As a consequence, if investor owned hospitals are profit maximizers, one would not expect to see them engaged in cost shifting.

Third, nonprofit status with market power by itself does not imply the ability to cost shift. The issue is the objectives of the organization. Cost shifting requires that the organization value setting prices to private patients at levels below those that would maximize profits.

Fourth, the model implies that cost-shifting behavior is limited. Once a provider exploits its unexploited market power, it has no further ability to cost shift.

Empirical Evidence On Cost Shifting

Ultimately the existence and magnitude of cost shifting is an empirical issue. The empirical evidence with respect to cost shifting has been mixed, but the rigorous research largely concludes that if it exists, its magnitude is modest at best. Unfortunately, much of the work simply misses the point because it seeks to show that different payers pay different prices for essentially the same services. This is true, but price discrimination is not cost shifting. Other work tries to use cross-sectional comparisons to test for the presence of cost shifting. This is difficult to achieve because cost shifting is a dynamic phenomenon. However, there have been five relatively recent papers that test for cost shifting using hospital behavior over time. See Morrisey (1994 and 1996) and Frakt (2011) for detailed reviews of the literature.

Hadley et al. (1996) used a national sample of hospitals over the 1987–89 period to examine the effects of financial pressure and competition on the change in hospital revenues, costs, and profitability, among other things. They found that hospitals with lower base-year profits increased costs less and increased their efficiency. With respect to cost shifting, ‘‘[w]e found no evidence to suggest that cost shifting strategies that might protect hospital revenues in the face of financial pressure were undertaken successfully’’ (Hadley et al., 1996, p. 217).

It is also noteworthy that this study, and all of those reviewed here, control for hospital ownership status, but do not formally test for differences in behavior by ownership type. This is a lost opportunity. The exception is the work by Zwanziger et al. (2000).

Dranove and White (1998) used 1983 and 1992 California hospital data to examine the effects of reductions in Medicaid and Medicare volume on changes in price–cost margins (i.e., net price minus average costs all divided by net price) of privately insured patients in Medicaid-dependent hospitals. They found ‘‘no evidence that Medicaid-dependent hospitals raised prices to private patients in response to Medicaid (or Medicare) cutbacks; if anything, they lowered them’’ (p. 163). They also found that service levels fell for Medicaid (and Medicare) patients relative to privately insured patients and fell by more in Medicaid-dependent hospitals.

Zwanziger et al. (2000) used California hospital data from the same source over the full time period 1983 through 1991 and reached decidedly different conclusions. They computed the average price per discharge for Medicare, Medicaid, and privately insured patients. Controlling for average costs in a two-stage model, they found that lower Medicare and Medicaid prices were associated with higher private prices. A one percentage point decrease in the Medicare average price was estimated to increase private prices at nonprofit hospitals by 0.23–0.59 percentage points. The larger price increases were found in markets with less hospital competition. They also found evidence that investor-owned facilities also engaged in cost shifting. Similar analysis by Zwanziger and Bamezai (2006) for the 1993–2001 period concluded that ‘‘cost shifting from Medicare and Medicaid to private payers accounted for 12.3 percent of the total increase in private payers’ prices from 1997 to 2001’’ (p. 197).

Cutler (1998) examined whether lower Medicare payments led hospitals to greater cost cutting or cost shifting. Using data from Medicare cost reports over the 1885–1990 and 1990–95 periods, he found that in the early period, hospitals shifted costs dollar for dollar to private payers – an effect larger even than the Zwanziger et al. study. However, over the later period he found no evidence of cost shifting. Cutler attributes the difference in the results to the advent of selective contracting in the early 1990s that increased the extent of price competition among hospitals.

The most extensive analysis of cost shifting undertaken to date is that of Wu (2010). She uses Medicare data to examine the long period from 1996 to 2000 focusing on the effects of the effect of the Balanced Budget Act on Medicare hospital prices. Unlike earlier work, she treats the Medicare variable as endogenous. Wu finds that hospitals shifted approximately 21 cents of each Medicare dollar lost to private payers. Cost shifting varied by the bargaining power of the hospital. When a hospital had more power vis-a` -vis insurers; it was able to shift more costs.

Conclusions

The most rigorous of the studies conducted in the past decade provide mixed evidence of the existence and magnitude of cost shifting in hospitals. Taken as a whole, the evidence does not support the claims of its proponents that cost shifting is a large and pervasive feature of US health-care markets. Only an early analysis by Cutler (1998) finds dollar-for-dollar increases in private prices as a result of lower Medicare payments. Even this finding is contained to a single short-run period. At best, one can argue that cost shifting, over the 15–20 years covered by the recent analyses, resulted in perhaps one-fifth of Medicare payment reductions being passed on to private payers. At worst, the majority of the rigorous studies found no evidence of cost shifting.

The theoretical literature strongly suggests that cost shifting can take place only if providers have unexploited market power. Once exploited, this avenue of response to changes in government payment policies disappears. This, together with the empirical findings, has three implications. First, policy advocates should worry much less about cost shifting. Although it can exist, other factors appear to be much more important in determining provider pricing. Second, the bulk of burden of reductions in government programs are borne by public patients. The consequences of such decisions cannot be shuffled off to private payers. Finally, health-care competition matters. One should look for evidence of cost shifting in markets and times that are characterized by provider concentration. If one is worried about cost shifting, encourage greater competition among hospitals, physicians, and insurers.

References:

- Cutler, D. (1998). Cost shifting or cost cutting? The incidence of reduction in Medicare payments. Tax Policy and the Economy 12, 1–27.

- Dranove, D. and White, W. (1998). Medicaid-dependent hospitals and their patients: how have they fared? Health Services Research 33(2), 163–185.

- Frakt, A. B. (2011). How much do hospitals cost shift? A review of the evidence. Milbank Quarterly 89(1), 90–130.

- Hadley, J., Zuckerman, S. and Iezzoni, L. I. (1996). Financial pressure and competition: changes in hospital efficiency and cost-shifting behavior. Medical Care 34(3), 205–219.

- Morrisey, M. A. (1994). Cost shifting: Separating evidence from rhetoric. Washington, DC: AEI Press.

- Morrisey, M. A. (1996). Hospital cost shifting, a continuing debate. EBRI Issue Brief, no. 180. Washington, DC: Employee Benefit Research Institute.

- Wu, V. (2010). Hospital cost shifting revisited: New evidence from the Balanced Budget Act of 1997. International Journal of Health Care Finance and Economics 10(1), 61–83.

- Zwanziger, J. and Bamezai, A. (2006). Evidence of cost shifting in California hospitals. Health Affairs 25(1), 197–203.

- Zwanziger, J., Melnick, G. A. and Bamezai, A. (2000). Can cost shifting continue in a price competitive environment? Health Economics 9(3), 211–225.