What Is Microinsurance?

Microinsurance does not have a single accepted definition. However, two well-known sources provide high-level definitions and describe salient traits that help establish what microinsurance is and what it is not. These are introduced in this section and used throughout this article to anchor the discussion.

- Dror and Jacquier’s seminal work coined the expression ‘microinsurance’ and defined it as voluntary, group-based, self-help insurance schemes for which the group designs the premium, benefits, and/or claims to be attractive, relevant, and affordable to excluded populations in the informal sector. This definition departs from classical demand-driven market theory which views the individual as formulating demand, whereas here the group takes that role, and group demand reflects its aptitude to pool both risks and resources in order to provide protection to all members. This definition can be viewed as applying the subsidiarity principle (that decisions should be taken at the lowest level where they can be taken). Hence, both the governance and the utility are mutually determined by those most concerned. And, because microinsurance is typically targeted at low income, poor people (even though this is not a necessary trait), it manifests atypical pooling and risk transfer.

- The International Association of Insurance Supervisors (IAIS) defines microinsurance as insurance for low-income people provided by a variety of institutions, run in accordance with generally accepted Insurance Core Principles, and funded by premiums proportionate to the likelihood and cost of the risk involved. Microinsurance serves populations in the informal sector that are excluded from or not served by other insurance.

These definitions have much in common:

- microinsurance is insurance (as distinct from savings and credit) and applies principles of risk pooling;

- coverage is always contributory (i.e., schemes that are 100% subsidized would not qualify as ‘microinsurance’);

- microinsurance is independent of the size of the risk-carrier (can be a local, informal mutual-aid society, or a large national or multinational insurance company);

- microinsurance is independent of the scope of the risk (risks do not become ‘micro’ when coverage is partial or the insured that experience them are poor);

- microinsurance is independent of the delivery channel (the most common options are small community-based schemes, credit unions, microfinance institutions, or local agencies);

- microinsurance is independent of the class of risk (life, health, crop, livestock, assets, etc.);

- microinsurance targets people in the informal sector;

- microinsurance is suited to people on low incomes (in the second definition this is a defining trait);

- affiliation to microinsurance is voluntary, the first definition makes this explicit and it is generally consistent with the tenor of the second definition.

Although both definitions identify that microinsurance suits poor people with low incomes, and it is an intuitively appealing place to start a definition, including it as a defining trait in the second definition raises operational problems. Measuring low income is complex especially when accounting for the depth of poverty, length of time of being low income, the phase of life (e.g., childhood vs. mid-life), and the comparative deprivation level by References: to the society in which a person lives. Thus, insurers rarely have the knowledge or the motivation to synthesize such complex information that is per se not relevant for underwriting risks. Furthermore, it is also not simple to determine whether premiums are proportionate to the likelihood and cost of the risk involved without specifying the method of premium pricing; this information is not revealed by habitual insurance performance indicators.

There is at least one fundamental difference between the two definitions, vis the role of the group. Because this radically fundamental distinguishes the definitions, the author explores it further.

Communities might variously be area-based, trade-based, faith-based, gender-based, cause-based, ethnicity-based, and other. The core assumption underlying the first definition is that the group is the framework within which cultural, demographic, and general economic factors are shaped in an otherwise unstructured ‘informal’ environment. The community relies on profound information that is not known outside the community and may have a different logic to that on which commercial insurance decisions are based. Without this group engagement, the market for insurance continues to struggle to establish viable supply and solvent demand for insurance.

Those that accept the second definition believe that commercial or other service providers have the capacity to establish viable supply for which demand can be assumed to exist.

Under both definitions, it is clear that if the scheme is not customized to be relevant to the specific context and needs of the community, it cannot be classified as microinsurance. This has erroneously been taken to mean that national microinsurance programs are not possible. If national programs can be tailored to local needs, they can be described as microinsurance.

How Common Is Microinsurance For Health?

Recent overviews of microinsurance activity in poor nations have shown a low penetration rate with some 3% of the poor in the world’s 100 poorest nations having some microinsurance in 2007, and only 0.3% having health microinsurance. These figures relate to insurance more consistent with the second definition than the first. Of the 78 million people covered by any microinsurance, only 3.2 million are covered by mutual or community-based organizations that would clearly fit the first definition. Although it is not clear what proportion of these 3.2 million have health microinsurance, it is manifestly apparent that health microinsurance consistent with the author’s definition has not reached many of the at least 2.5 billion people who need it. Although a raft of barriers to the growth of microinsurance have been identified, the most fundamental include: poor distribution channels and poor business infrastructure; a history of mandated credit life insurance that builds antagonism among consumers; a prevalence of commercial microinsurance schemes that, although compliant with government requirements, often provide no benefits to the poor; ill-fated attempts to build universal coverage of health insurance where there are neither funds for such a scheme nor adequate available health services. Moreover, regulation remains poor with microinsurance sometimes being ignored by policy and sometimes included without distinction, and the best practice is yet to be identified.

Stated simply, the market (both supply and demand) for health microinsurance remains small or even nonexistent in most settings. If insurance were simply a risk-transfer tool, health microinsurance would theoretically be attractive to low-income populations who are exposed to many and various health risks. Moreover, Nyman’s game-changing assertion that health insurance is demanded because it provides an income transfer from the well insured to the sick insured irrespective of risk management, suggests that microinsurance for health would be particularly attractive among the poor who practice reciprocity (rather than state-mandated cross subsidization or solidarity) for their burden of disease. And, notwithstanding the Prospect Theory’s challenge to the validity of risk avoidance as a rational motive for insurance, there remains widespread acceptance that the market for insurance in general and health insurance in particular is a market for risk avoidance.

Yet, the typical situation observable everywhere is a dearth of both supply and demand for health insurance at the informal sector in low-income countries, which the private/ commercial sector and government are ill-suited to resolve because the economic and behavioral choices in the informal economy differ fundamentally from those prevailing in rich and orderly/rule-based economies. These behaviors and decisions are often regulated or shaped by community interests in ways that may be inconsistent with the expected behavior of a single individual economic actor.

Given that poor excluded populations have great health risk and are in need of income transfer when ill and that they live in communities that can give structure to both the supply and demand side, why then is community-based microinsurance for health not more prevalent? The reason is that successful insurance, even at the community level, requires technical and actuarial knowledge as well as advanced financial literacy, which are sorely missing in the informal sector. Therefore, these barriers to success cannot typically be overcome without external drivers to develop capacity and drive institutional change that will enable markets to establish. In this sense, the lack of a market for micro health insurance is a failure of context rather than market failure.

Typology Of Microinsurance Business Models

At least four basic operating models to deliver health microinsurance have been described as ‘microinsurance’:

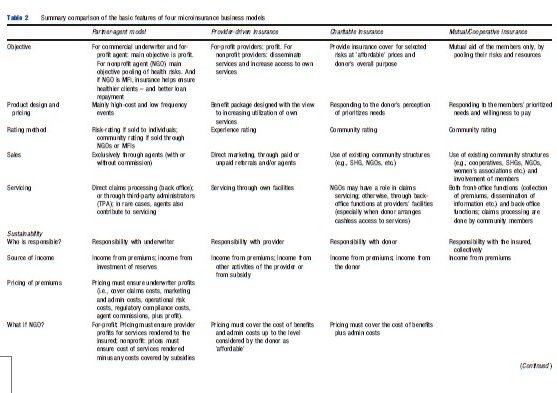

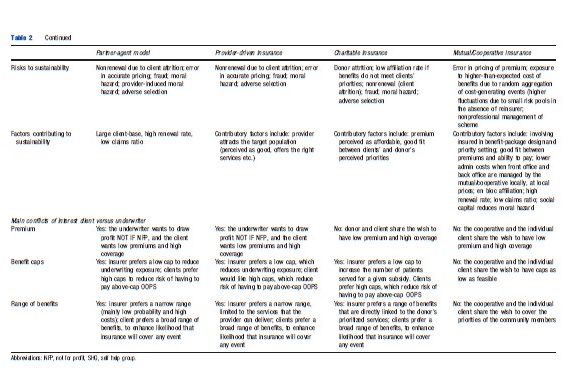

- The partner-agent model in which the role of the insurance company (‘the partner’) includes designing, pricing and underwriting of products, and responsibility for scheme solvency in the long-term. Distribution/marketing, premium collection, and product servicing are usually delegated to an intermediary (‘the agent’), often a person or a for-profit legal entity. Insurance companies usually pay agents a commission on premiums sold. This remuneration method is effective in urban settings and among solvent populations, but less so in the informal sector, where reaching persons may cost much time, and lead to few closed sales. This is why, in Africa and in Asia, insurers have been keen to assign the agency role to bodies that interact frequently with rural and low-income populations, such as nongovernmental organizations (NGOs) or Micro Finance Institutions (MFIs). Where MFIs have identified a need for health insurance (e.g., when illness caused default on repayment of debts), they have sometimes approached insurers to design a suitable insurance product, and suggested the price range that would be acceptable, and pressured providers for better services and claim settlement.

The partner-agent model could qualify as ‘microinsurance’ under the second definition if it offered insurance to low-income people, but may not qualify under the first definition as the design decisions are taken by insurers, not by the community. That said, when MFIs acting as agents also involve the community in the bidding process and in priority setting, one could argue that this is a borderline situation that could also meet the requirement of the first definition.

- The provider-driven model, in which clients pay premiums to the healthcare provider (e.g., hospital, physician), which in turn enables them to consume health services without having to pay out of pocket at the point and time of service. The healthcare provider benefits from this arrangement by creating larger solvent demand for health services, sold mainly by the provider-insurer; and increasing and smoothing the cash flow as it is dissociated from incidence of illness.

The healthcare providers are responsible for designing, pricing, and underwriting insurance products and for the long-term sustainability of insurance operations.

The provider-driven model could qualify as microinsurance under the second definition if the client-base of the insurance is composed of poor people. However, it is unclear whether low-premium policies that include rare and expensive surgical procedures would still qualify as ‘microinsurance.’ Under the first definition, this arrangement would not qualify as ‘microinsurance’ as the decisions on pricing, package design, and claims settlement are taken by the provider-insurer according to its commercial interests and capacity to provide, possibly without inputs from, or participation of the community in governance of the insurance. Although there are examples of the healthcare provider investigating need for and willingness to pay (WTP) for health insurance, in all cases the role of the community was limited to passive informant rather than meaningful engagement in decision making.

- Charitable insurance model (a.k.a. ‘full-service’ model), in which an external charitable organization, acting as ‘insurer,’ assumes responsibility for the long-term sustainability of the scheme by supplementing the payment of premiums, because there is an assumption that contributions could never cover all costs of benefits provided. Many charitable insurers are run by NGOs, many are operating not-for-profit, and many may view the insurance as a suitable vehicle to promote their main development, or religious goals. The external donor retains much of the responsibility for product design, pricing, and administering the scheme, in ways that would align with the fundamental objectives of the organization. Thus, there are instances where the charitable insurer fixes premiums below the actuarial cost, or does not enforce the requirement that only paid-up insured can access benefits.

The charitable insurance model could qualify as ‘microinsurance’ under the second definition when the financial arrangement protects low-income people against specific perils in exchange for regular premium payments proportionate to the likelihood and cost of the risk involved; it would not qualify as ‘microinsurance’ when the payment of premium is irregular, and/or when that premium is disproportionate to the risks involved. Under the first definition, charitable insurance would qualify as ‘microinsurance’ when the community of beneficiaries participates in key decisions and in governance of the scheme, and would not qualify as ‘microinsurance’ otherwise.

- Mutual/cooperative insurance model, in which the insured is also the insurer, so that each member of the mutual (or cooperative), together with all other members, is simultaneously benefitting and underwriting at least part of the risk. The community of members is thus responsible for all aspects of the scheme including designing, pricing, and underwriting products and for the long-term solvency of the insurance. The mutual model finds its origins in nineteenth-century Europe, and has been launched, designed, implemented, and administered by and for groups of people without access to the resources and financial techniques of commercial insurance. Being directly in contact with its membership, this insurer can ‘disintermediate’ the agent role and save agent commissions. As the interests of mutual insurers are identical to those of its members, the first priority is to establish a good fit between the needs of members and the benefit package. Many mutual societies are not only insurance providers, as they function as broader mutual-interest organizations. Some mutual organizations have grown to be very large and have professional management, which can distance the operations from the members, resulting in less social cohesion in large mutuals than in community-based schemes.

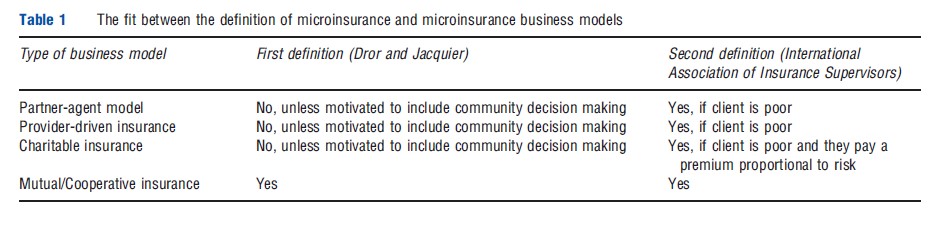

The mutual/cooperative insurance model could qualify as ‘microinsurance’ under the first and second definitions, provided that the insurance covers low-income people, and the community of beneficiaries participates in key decisions and in governance of the scheme. It is in fact the only model that could satisfy both definitions of ‘microinsurance’ (Table 1).

In reality, any health microinsurance scheme can have features of multiple models. For example, in Uganda, there are several mission hospitals that run provider-driven insurance schemes, yet they are heavily subsidized, and thus similar to a charitable scheme. Moreover, schemes can start as one model and change over time, as did the Yeshasvini Trust in India, which was initially founded by healthcare providers, and is currently run as a not-for-profit charitable model. The providers largely designed the current benefit package and the trust developed as a mixture between a charitable model and provider-driven model.

Insurance Failures Under Microinsurance

There is no principal difference between health microinsurance and any other health insurance in terms of exposure to insurance failures, but there are, or can be, significant differences to exposure under the different business models. The phenomena usually considered as ‘insurance failures’ include adverse selection, cream skimming, moral hazard, free riding, and fraud.

Adverse selection describes the situation in which an insurer accepts offers of insurance of high-risk persons at rates that do not reflect the actuarial premium attached to their risk class because the insurer does not have full information about the risk that these individuals represent. In response, insurers increase premiums to fund higher costs, which lead to lower participation of people with lower risks, and could even lead to exit of higher risks due to unaffordable premiums. Adverse selection is more likely to occur when affiliation is based on individual contracts and is voluntary, and is least likely when affiliation is mandated for a large group. The effective countermeasure to adverse selection is ‘en bloc affiliation’ of an entire community, even when this is not obligatory.

In the context of health microinsurance, adverse selection is more likely to occur under partner-agent, provider-driven, and charitable models, when they allow voluntary and individual affiliation. En bloc affiliation occurs often under the mutual/cooperative model, and sometimes under the partneragent model when the agent is a strong NGO that can in fact affiliate an entire community.

Cream skimming, also known as ‘preferred risk selection’ or ‘cherry-picking’ (and when it takes the form of nonrenewal it is called ‘lemon-dropping’), occurs when an insurer selects only part of a large heterogeneous group which the insurer estimates as being lower-than-average risk (the preferred risks) without discounting the risk-rated premium they are required to pay. The purpose of cream skimming is to enable the insurer to retain profits by reducing the loss ratio.

In the context of health microinsurance, cream skimming occurs when the standard contract includes certain limitations by age (e.g., the insurance is valid only from age 3 to age 60), or by health status (e.g., excluding certain illnesses, chronic conditions etc.), or by benefit types (e.g., cover only a limited list of procedures requiring hospitalizations etc.). Clearly, exposure to this situation is more likely to prevail when the underwriter has free hand in determining the terms of the policy (this is frequently the case in the partner-agent model or the provider-driven insurance) and is less likely to occur when the insured can influence the terms of the policy (as in the mutual/cooperative model).

Moral hazard is the increase in healthcare utilization that occurs when a person becomes insured, which is an insurance failure because insurers pay out more in benefits than was expected when setting premiums. The conventional interpretation is that this additional healthcare utilization represents a loss to other insured people, as they ultimately bear the cost of additional demand. Nyman pointed out that this interpretation is based on the assumption that the extra healthcare is not clinically needed (e.g., cosmetic surgery), but where the extra demand is needed the extra care is a gain to society. Although increased utilization patterns cannot automatically be considered as bad outcomes (as suggested by the term ‘hazard’), they are insurance failures when payout exceed actuarial estimates. The conventional remedy for moral hazard is to require consumers to pay part of the cost (i.e., copay) in every case, or that the insurer can legitimately control utilization.

In the context of health microinsurance, given that the target populations chronically underutilize health services, it would be reasonable to expect that health insurance would lead to increased utilization of services covered by the particular health microinsurance scheme. This theoretic welfare gain is borne out by empirical research in India and the Philippines, which indicate a transition from underutilization to normal utilization, as the income transfer overcomes the financial constraints on accessing healthcare. Under the mutual-aid model, where community of insured is simultaneously also the underwriter, the community has very good information on its members when the group size is small. Thus, it can exercise peer pressure to reduce moral hazard.

Moral hazard can also be induced by providers of care that benefit from overtreating insured persons. ‘Supply-induced moral hazard’is not easily detected or limited in the context of health microinsurance, but low insurance caps obviously limit not just the cover but also the margin of providers to generate overconsumption. Under the provider-driven insurance model, the provider can exercise better control of supplierinduced moral hazard, but at the same time the provider might be in a situation of conflict of interest to do so.

Free riding arises when a person benefits from the health insurance scheme without paying premiums. This risk is due to imperfect monitoring of those drawing benefits; cashless delivery of services can increase the risk of free riding. The countermeasure for this is to improve monitoring of the system with the view to ensuring that only legitimate beneficiaries will draw benefits. Smart cards and similar electronic devices are increasingly popular aids to monitoring.

In the context of health microinsurance, where there is very little access to IT and where online/real-time access to an management information system (MIS) is rare, it may not be feasible to reduce free riding through automated checks of claims. Rather, the remedy to free riding would consist of creating a counteracting interest to disallow or adjust payments. The mutual/cooperative model has such inherent characteristic, in that all members are simultaneously insurers and insured, share the same informal, local information that circulates informally and free-of-charge (i.e., gossip), and have (or could have) a say in claims adjudication. Thus, they have both the incentive to reduce costs (as excessive payments would translate into higher premiums) and the responsibility to settle claims (and can therefore filter unjustified ones).

Fraud is when someone knowingly provides inaccurate or incomplete information to claim benefits or advantages to which they are not entitled, or someone knowingly denies a benefit to which someone else is entitled and that is due. This issue is similar to free riding (although there may also be provider-induced fraud).

In the context of health microinsurance, the two business models that can reduce the risk of fraud by narrowing the gap between the flow of information and the flow of funds are the provider-driven insurance model and the mutual/cooperative model. This is because the underwriter also has much information on the claimants that can be availed free-of-charge. Provider-insurers in the provider-driven insurance model are in a potentially strong position to undertake provider fraud, which they can avoid only when they refrain from acting on their incentive to maximize profits. Operators in the mutual/ cooperative model have no particular access to information on provider fraud, and would have to rely on investigation as would underwriters operating the partner-agent model and the charitable model, which could be disproportionately costly relative to the small sums insured.

Clearly, operators in the mutual/cooperative model have greater access to information that reduces or removes insurance failures arising from asymmetric information, i.e., adverse selection, moral hazard, free riding, and fraud. The exception is information asymmetries on provider-induced moral hazard and provider fraud, for which the insurer-providers in the provider-driven insurance model have an information advantage. Absence of such information exposes the other business models to greater risk of failure (Table 2).

Application Of Specific Actuarial Issues To Microinsurance

It is often stated that insurance is a numbers game relying on the Law of Large Numbers, vis: that the larger the number of independent risks in a pool, the lower the variance of mean losses. Lower variance translates to lower pure risk premium. Yet, most health microinsurance schemes are small, their intrinsic capacity to diversify risks limited, and their exposure to covariate risk is high due to the homogeneity of their clients. Simulation studies have shown that capital loadings to secure solvency are exponentially higher for small schemes. Notwithstanding the financial advantages and potential of lower premiums, pooling of schemes on a voluntary basis has not occurred. Pooling small schemes would be relatively simple if they all had an identical risk profile and shared priorities. In reality, health microinsurance schemes usually cover locationspecific risks and priorities, which make pooling schemes more complex because of the differences from scheme to scheme and from community to community. The potential for governments to put in place mechanisms to adjust risks across mandatorily pooled schemes is remote, given the voluntary nature of microinsurance, and the damage such regulatory intervention could have on the role of the community in designing premiums and benefits. A proposal to create reinsurance for microinsurance (labeled ‘social reinsurance’), which would provide large pool efficiencies at the reinsurance level, has so far not been implemented.

A paucity of data and its quality with which to determine stochasticity and quantify risks is a perennial problem for microinsurance, particularly health microinsurance. This means that launching a new micro health insurance (MHI) scheme must be preceded by data collection to ensure that premiums reflect rigorous risk estimates, and benefits are customized to address the main risks. Some early movers in the health microinsurance market took a simpler approach to the problem of lack of data by downsizing commercial insurance products that they had developed for the entire country instead of designing specific products with accurate pricing for this market based on a deep understanding of the particular needs of potential customers of microinsurance. The low uptake of such low-cost-low-benefit packages indicates that this approach was not suitable.

Some MHI schemes have introduced innovations in coverage that have actuarial ramifications. For example, in India and Nepal, where entire families share one ‘purse,’ some schemes have introduced a ‘family floater’ condition (i.e., a capped benefit which can be used by one or more members of that household) which requires rather sophisticated actuarial calculations to triangulate the estimated loss ratios to the distribution of family size.

In addition to ensuring that the pure risk premium is commensurate with the risk covered, actuaries need to calculate loadings on the premium to cover administrative, operational, and other costs, and, in some business models, profit. Given the high transaction costs associated with business models other than the mutual/cooperative business model, there is rationale to increase premiums, which is at odds with the clients’ apparent WTP. In the absence of an acceptable notion of an equitable price, setting the premiums is fraught with uncertainties.

A different approach to explaining the link between premium and coverage has been to say that in microinsurance the price determines the coverage, whereas in other insurance the product determines the price; this point is elaborated in the Section The ‘Make-It-Or-Break-It’ Factor of Microinsurance: Willingness to Pay.

The ‘Make-It-Or-Break-It’ Factor Of Microinsurance: Willingness To Pay

Under all definitions and types of health microinsurance, prospective clients, who are mostly living and working in the informal economy of low-income countries, affiliate on a voluntary basis. These people cannot be obliged (by governments or others) to pay a premium, even when subsidies cover a share of the expected costs. This means that the WTP of the target population determines the insurance package, rather than the product determining the price, as is typical in insurance. Therefore, WTP is the make-it-or-break-it factor of health microinsurance.

This is why it is essential to estimate WTP before launching the insurance. The most common method for prelaunch estimation of WTP for health microinsurance is contingent valuation (CV), which surveys the target population’s responses to hypothetical insurance products and premiums. Respondents are required to think about the contingency (or feasibility) of an actual market for the benefits, and state the maximum they would be willing to pay for them. Over the years, different methods have been developed for the presentation of scenarios and the analysis of the responses.

WTP for health microinsurance is positively associated with income and increases nominally as income rises, but when expressed as a proportion of income, WTP declines as income grows; education; the quality and availability of health services; and recent exposure to healthcare costs. Men are willing to pay higher amounts than women. However, empirical evidence from India and Nigeria show that notwithstanding these variables, WTP is highly location specific, meaning that any temptation to roll out a one-size-fits-all microinsurance (be it in order to capture economies of scale in administering policies, or to establish some kind of a prescribed minimum level of benefits, or to aggregate the risk of more insured persons) may be thwarted. As WTP is location specific, so health microinsurance should be context-relevant in order to succeed. The related question is whether people actually pay the expressed WTP; at this point in time there is not enough published evidence on this question in the context of microinsurance.

The Impact Of Health Microinsurance, And Why It Is Not More Common

Early attempts to assess the performance of microinsurance for health were limited to measuring several accounting ratios, mostly reflecting financial performance of schemes. More recently, the product, access, cost, and experience (PACE) is used by practitioners to develop a better value-proposition for clients by comparing various microinsurance products to one another and to alternative means of protection from similar risks (including informal mechanisms and social security schemes). However, neither the performance indicators nor the PACE tool offer conclusive and robust insight to three fundamental issues: (1) what difference does the insurance have on utilization of healthcare services among the insured? (2) what difference does the insurance have on the financial exposure/protection of the insured? and, (3) what impact does insurance related improvements in healthcare utilization have on the health of the target populations? These are considered in order as follows:

- What difference does the insurance have on utilization of healthcare services among the insured? A literature review aimed at answering the question, ‘Do clients get value from microinsurance?’ suggested that ‘value’ included three aspects: (1) Expected value – the value clients may get from a product through behavioral incentives and peace of mind, even if claims are not made; (2) Financial value – the value of the product when claims are made compared with other coping strategies; and (3) Service quality value – the externalities created by microinsurance providing access to product-related services of benefit to the client. Answers to these questions were sought in 83 studies on health microinsurance products. According to that report, some 43 studies found that health insurance positively influenced the use of health services. And some 33 studies generally found that insurance led to lower out of pocket spending (OOPS) in case of hospitalization. The major impact of insurance on increasing utilization of health services was confirmed by a different literature review using the randomized controlled trials (RCT) method of measuring impact, and the Cochrane Handbook’s characteristics.

These findings should be put in context. In high-income countries it is often assumed that increased utilization of health services among voluntarily insured persons suggests (or is evidence for) adverse selection (namely, higher propensity to insure among persons who are likely to have above-average healthcare utilization). This assumption is not supported by the findings of studies of healthcare utilization among clients of health microinsurance, where higher frequency of illness was not systematically associated with insurance status, suggesting that in these populations the assumption of adverse selection must be rejected. Rather, it seems that most of the target population for health microinsurance in low-income countries suffers from chronic underutilization of healthcare services, due to the inability to pay for more or better healthcare. Thus, improved utilization of health services among the insured population is an indicator of success in achieving a key objective of health microinsurance, of reducing the limiting factor of unaffordability.

However, the utopian aspiration that health microinsurance would put in place both more utilization and more equitable distribution of that utilization may be too much to ask, considering the inherent limitation of microinsurance. The poorer the insured person, or the lower the coverage relative to the full cost of services, the more likely it is that insured persons would be unable to pay any copay required to access insured benefits. Thus, the effect of health microinsurance schemes on equality is ambiguous in theory, and in practice, it has been observed to be both positive and negative.

- What difference does the insurance have on the financial exposure/protection of the insured? One possible indicator of the impact of microinsurance on financial protection is the total OOPS that the insured must bear when accessing insured benefits taking into account also indirect costs and premiums. Although no such analysis has been published, there has been discussion of ‘catastrophic’ healthcare costs, which have been defined in terms of percentages of household income or disposable income net of subsistence needs. Although such definitions have been used to show significant reductions in the incidence of catastrophic costs among members of health microinsurance schemes, the definitions are insensitive to relative levels of hardship and other healthcare cost-related factors that lead to hardship such as the need to get money quickly, which may necessitate borrowing at high rates and/or selling assets on unfavorable terms. Such ‘hardship financing’ can be more costly than the healthcare and can throw the sick into poverty. Therefore a more appropriate impact indicator might be the extent to which health microinsurance reduces the frequency or intensity of hardship financing. Studies using this alternative indicator are yet to be carried out.

The impact on medical expenditure patterns (disregarding indirect costs and premiums) have been studied in various contexts with mixed findings. Some studies have found OOPS (defined as healthcare expenditures net of reimbursement by insurance, either per visit or over the course of an illness) decreasing whereas others found no effect. However, OOPS based measures ignore both premium payments and frequency of visits. Other studies assessed the impact on total annual healthcare spending, either per person or per household, and found an increase in annual health spending because although the cost of individual visits sometimes decreases under health microinsurance, the number of visits typically increases, potentially leading to increased overall expenditure. However, these findings are obscured by the failure of the studies to control for changes in the price of healthcare and changes in household income. Finally, three schemes have been evaluated for their effect on some measure of the socioeconomic status (SES) of insured households. Although two schemes reported a statistically significant increase in SES with higher levels of income growth among households which are insured, and/or reduced likelihood to sell off their food stocks to pay medical bill, the third found no effect of insurance on household income levels, assets levels or self-reports of food sufficiency.

The literature on estimating or measuring financial protection of microinsurance must be considered with reserve, due to the challenge of obtaining a statistically valid comparison between insured and uninsured cohorts. Most studies compare utilization of healthcare benefits by the insured with the utilization by persons residing in the same geographical area who are not insured. These comparisons were flawed on several counts: Firstly, they were usually one-off studies following implementation of the microinsurance that did not adequately examine whether the cohorts were different before implementation of the insurance and whether any difference was attributable to the intervention or to an inherent difference between the cohorts. Secondly, a simple comparison of the situation among the insured cohort before and after implementing health microinsurance could be misleading because one cannot exclude the possibility that several changes occurred that were unrelated to the intervention but which had an impact A recent publication explains the methodology elaborated to address such a challenge, following Cluster Randomized Controlled Trial protocol. The method is tested in three waves of microinsurance implementation, ensuring that at the end of the experiment the entire population is offered affiliation with a community-based health microinsurance, but through staggered affiliation. In each wave, villages are grouped into congruous preexisting social clusters; these clusters are randomly assigned to one of the waves of treatment. Before each wave, a baseline evaluation is conducted (using mixed methods, with quantitative, qualitative and spatial evidence collected on the situation). This method assures that the microinsurance schemes operate in an environment replicating a nonexperimental implementation and that all households are offered insurance.

- What impact does microinsurance have on the health of the target populations? The few studies have explored the health outcomes of health microinsurance have generally found that although healthcare utilization has increased, it is too early to say if the insured have better health. In some cases, there has been a lack of baseline information on health status, making evaluation more difficult. The scant evidence available suggests that any improvement in health outcomes is typically skewed toward the wealthier members of the schemes, possibly because they are better informed about health and have better access to noninsured care and support.

Concluding Note

If health insurance is a ‘numbers’ game,’ and if health microinsurance is the pro-poor variant of health insurance, then it should become the dominant model by virtue of the huge number of persons in the informal sector without health insurance, of whom many are poor. However, progress to develop both supply of and demand for health microinsurance is contingent on developing a workable business model. With most of the target population living and working in the ‘informal sector’ where governments cannot mandate payment of premiums or apply means-testing for partial subsidization, the implementation of MHI depends on WTP. At the current level of knowledge of how to estimate WTP, it seems that participatory, needs-based, context-relevant, partial, and complementary solutions offer more promise than supplydriven one-size-fits-all products or mandated dissemination models. The partner-agent model remains subject to acute risk of conflicts of interest between underwriter, agent and client, which is never eliminated. Provider-driven supply of health insurance has so far not offered a general formula for scaling. The charitable model, based on delivering subsidized health microinsurance is limited by the funds that the charitable donors can devote in the long term. The mutual/ cooperative model, though typically small scale can overcome most barriers to establish a functioning market for health insurance among the poor.

The poor want health insurance and can pay premiums and health microinsurance can operate without subsidy, but possibly not at profit and not with extensive commercial intermediation. The low penetration of health microinsurance can be explained in terms of barriers to the establishment of a market with viable supply and solvent demand in the informal sector. This overall context failure cannot necessarily be solved by the insurance industry offering innovative products through various channels, and cannot necessarily be solved by government regulation, although innovation and regulation are essential if we are to put in place systemic (regulatory and financial) mechanisms to encourage the development of local health microinsurance schemes or to pool risks across schemes, or articulate the relations between local schemes and commercial underwriters and reinsurers. Communities have a central role to play in building capacity and awareness, providing information for actuarial calculations and scheme designs to suit local priorities and service availability, and building the institutional context in which viable supply and solvent demand can be established. That said, local grassroots initiatives are neither willing nor able to scale microinsurance over entire countries.

Preferred Definition Of Microinsurance For Health

As a conclusion, the preferred definition of health microinsurance is as follows:

Health microinsurance is insurance contextualized to the WTP, needs and priorities of people in the informal sector who are excluded from other forms of health insurance. The schemes are voluntary, with premiums suited to people with low incomes. Although health microinsurance is independent of the size of the insurer, the scope of the risk covered, and the delivery channel, it is essential that the scheme is designed to benefit the insured. For practical intents and purposes, this definition implies a central role for the community in at least the design of the scheme, and possibly its operation and governance.

References:

- Dror, D. M. and Jacquier, C. (1999). Micro-insurance: Extending health insurance to the excluded. International Social Security Review 52(No. 1), 71–97. (Geneva), ISSA.

- IAIS (2007). Issues in regulation and supervision of microinsurance. Available at: http://www.iaisweb.org/view/element_href.cfmsrc=1/2495.pdf (accessed on 21 June 2013).

- Matul, M., McCord, M., Phily, C. and Harms, J. (2009). The landscape of microinsurance in Africa. Available at: http://www.ilo.org/employment/Whatwedo/ Publications/WCMS_124365/lang–en/index.htm (accessed on 21 June 2013).

- McCord, M., Tatin-Jaleran, C. and Ingram, M. (2012). The landscape of microinsurance in Latin America and the Carribean. Available at: http:// www.munichre-foundation.org/dms/MRS/Documents/Microinsurance/2012_IMC/20121010_Landscape_Microinsurance_LAC.pdf (accessed on 21 June 2013).

- Roth, J., McCord, M. J. and Liber, D. (2007). The landscape of microinsurance in the world’s 100 poorest countries. MicroInsurance centre. Available at: http:// www.microinsurancecentre.org/resources/documents/doc_details/634-thelandscape-of-microinsurance-in-the-worlds-100-poorest-countries-in-english.html (accessed on 21 June 2013)

- (2012). Securing the silent: Microinsurance in India the story so far. Available at: http://www.microsave.net/resource/securing_the_silent_microinsurance_in_india_the_story_so_far#.UV1dvaJHLoI (accessed on 21 June 2013).

- Binnendijk, E., Dror, D. M., Gerelle, E. and Koren, R. (2013). Estimating willingness-to-pay for health insurance among rural poor in India, by References: to Engel’s law. Social Science & Medicine 76, 67–73.

- Dror, D. M. and Armstrong, J. (2006). Do micro health insurance units need capital or reinsurance? A simulated exercise to examine different alternatives. The Geneva papers on risk and insurance 31, 739–761. Available at: http://ssrn.com/abstract=1017101 (accessed on 21 June 2013).

- Dror, D. M. and Koren, R. (2011). The elusive quest for estimates of willingness to pay for health micro insurance among the poor in low-income countries. In Churchill, C. and Matul, M. (eds.) Micro insurance compendium II, 2012, pp 156–173. Geneva: ILO and Munich Re Foundation.

- Dror, D. M., Koren, R., Ost, A., et al. (2007). Health insurance benefit packages prioritized by low-income clients in India: Three criteria to estimate effectiveness of choice. Social Science & Medicine 64(4), 884–896.

- Nyman, J. (2003). The theory of the demand for health insurance. Palo Alto, CA: Stanford University Press.

- Aggarwal, A. (2010). Impact evaluation of India’s ‘‘Yeshasvini’’. Community Based Health Insurance Program, Health Economics 19, 5–35.

- Dror, D. M., Radermacher, R., Khadilkar, S. B., et al. (2009). Microinsurance: Innovations in low-cost health insurance. Health Affairs (Millwood) 28(6), 1788–1798.

- Magnoni, B. and Zimmerman, E. (2011). Do clients get value from microinsurance? A systematic review of recent and current research. The Microinsurance Centre MILK project. Available at: http://www.microinsurancecentre.org/milk-project/ milk-docs/doc_details/811-do-clients-get-value-from-microinsurance-asystematic-review-of-recent-and-current-research.html (accessed on 21 June 2013).

- Wagstaff, A., Lindelow, M., Jun, G., Ling, X. and Juncheng, Q. (2009). Extending health insurance to the rural population: An impact evaluation of China’s new cooperative medical scheme. Journal of Health Economics 28(1), 1–19.

- http://www.microinsuranceacademy.org/ Micro Insurance Academy.

- http://www.microinsurancecentre.org/ MicroInsurance Center.

- http://www.ilo.org/public/english/employment/mifacility/ Microinsurance Innovation Facility.

- http://www.microinsurancenetwork.org/ Microinsurance Network.