The specialty of radiology, diagnostic imaging, has revolutionized the practice of medicine across the globe. No other form of diagnostic medicine has had such a dramatic impact on disease detection and mapping progression of treatment in the preceding decades. In a 2001 survey of physicians, magnetic resonance imaging (MRI) and computed tomography (CT) scanning ranked number 1 amongst 30 medical innovations of the last 25 years, beating cholesterol-lowering HmGCoA reductase inhibitors (statins), coronary arterial bypass graft, and newer generation antibiotics (Fuchs and Sox, 2001).

With the diagnostic imaging technological revolution has come the inherent increased costs of the technology itself. With CT scanners and MRI scanners costing upward of $3 million (US), the utilization of these machines at an ever increasing pace has helped drive up the medical bills of patients everywhere.

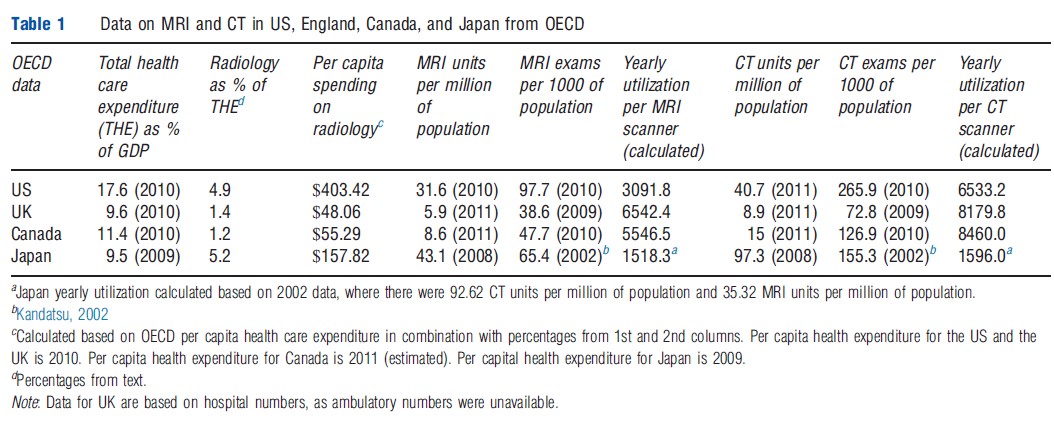

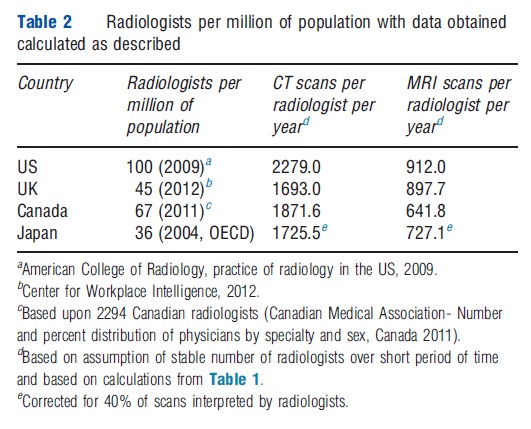

One of the benefits to having diagnostic imaging technology disseminated throughout the world is to provide a window into how the differing health care delivery systems tackle this issue of managing cost and utilization in the face of limited resources. In this article, four countries are studied: the US, the UK National Health Service (excluding Scotland), Canada, and Japan. The US provides a window into their blend of private and government-sponsored health care systems. The UK and Canada allow a glimpse into two variants of government-run health care. Japan allows for an analysis of their social insurance health care system, which has the highest per capita number of CT and MRI scanners of the comparison countries. As can be seen from Tables 1 and 2, these countries differ substantially in their numbers of advanced diagnostic equipment (CT and MRI scanners) as well as radiologists per capita. This article will document these differences and provide some suggestions of possible contributing factors. More rigorous analysis of determinants of cross-national differences in technology uptake and their effects on health outcomes remains an important subject for future research.

United States

Health care in the US is a mix of private and government sponsored methods of financing and care delivery. Insurance coverage largely depends upon age, income, and employment. For the majority of the adult population under the age of 65, private insurance is obtained through the workplace. Employer-sponsorship of health insurance takes advantage of tax preferences , facilitates contract negotiation for employees, and creates an insurable pool of enrollees. Those who are not employed or who do not have employer-sponsored health care (sole business owners, independent contractors), can buy insurance directly from insurance companies in what is known as the individual market. Much of the Patient Protection and Affordable Care Act of 2010 is devoted to reforming this individual market, such as removing preexisting condition exclusions, setting medical-loss ratios for insurance companies, and creating health insurance exchanges to provide information and subsidies to individuals who purchase these policies.

For senior citizens over the age of 65, there is government sponsored Medicare. This program, which is administered by private carriers, sets provider payments for hospitals and physicians nationally, including reimbursement for radiology. The program is funded by a combination of payroll taxes on workers, general revenues and premiums paid by beneficiaries. Finally, a subset of people below the poverty line are eligible for Medicaid. Medicaid is government-sponsored by both Federal and state governments. Provider payments are set on a state-by-state basis and the program is funded via taxes. People who fall outside of these public and private programs remain uninsured, except for minor additional programs. Private insurance programs (employer-sponsored and individual) for those under the age of 65 tend to follow the national fee structure provided by Medicare.

Among the four countries considered, the US has the most radiologists per capita. In addition, the US has the second highest number of MRI and CT scanners compared with the other countries. The high number of scanners can in large part be attributed to the fee-for-service system, a system that rewards doing more per patient. The majority of the country has no limits regarding the number of scans performed or the number of scanners in operation, with only a few state-based exceptions where a certificate of need is required prior to the purchase of a scanner. For every scan performed, a fee is collected, and thus the incentive to perform higher volume of scans. The higher volume of scans translates to a higher volume of scanners.

Payment for imaging services in the US is, in general (driven by Medicare), split into two categories: technical fee and professional fee. The technical fee is that which goes to the owner of the imaging equipment. The professional fee goes to the radiologist for interpretation of the study. Typically, the professional component is much less than the technical component, reflecting the relatively high equipment costs. In 2011, for example, a CT scan of the head carried a professional fee around $40, as compared to the technical fee of around $150.

A major legislation undertaken by the Federal government to curb cost and growth in imaging was enacted in the Deficit Reduction Act of 2005 (DRA 2005). This legislation reduced the technical fee payment for contiguous body part scanning. Hence, a CT scan of three contiguous body parts, such as the chest, abdomen, and pelvis, where the reimbursed technical fee was 100% for each, became 100% for the chest and 50% for the abdomen and pelvis (Moser, 2006). In 2012, Medicare further reduced payments to radiologists by decreasing the professional fee on a second body part for patients scanned on the same day by 25%. Although these changes primarily impact Medicare patients, insurance carriers tend to follow Medicare rates, giving this legislation tremendous impact. Indeed, Medicare rates indirectly serve as a ‘national fee schedule.’ As a result of the DRA 2005, imaging volumes in radiology offices decreased 2.0% between 2006 and 2007, as compared to yearly increases of 8.4% between 2002 and 2006 (Levin et al., 2009).

Table 1 Data on MRI and CT in US, England, Canada, and Japan from OECD

Table 2 Radiologists per million of population with data obtained calculated as described

The Organization for Economic Development and Cooperation (OECD) data indicate that the US, as compared to UK, Canada, and Japan, has the highest total health expenditure on imaging as a percent of gross domestic product (GDP) (Table 1). The US ranks second among this group in terms of number of CT and MR scanners per million, with Japan taking the top spot. The US also has by far the highest number of scans – both MRI and CT – per capita population, implying that there is a relatively high level of access to imaging technology in the US. However, when utilization per scanner is estimated (number of scans per scanner), the country falls to the second to last in terms of MR and CT utilization, indicating a relative under utilization of imaging equipment compared to other countries. Indeed, the US and Japan are the only high-income countries in the world, which allow for essentially unrestricted acquisition of high-technology scanners in a fee-for-service environment (Cutler and Ly, 2011). It is, therefore, not surprising that both of these countries have more scanners and lower utilization of scanners compared to the UK and Canada.

The number of radiologists practicing in the US is around 100 per million population (Table 2), the highest of the analyzed countries. In contrast to the relatively low scanner utilization in the US, the radiologist utilization is the highest, indicating that the US radiologist is reading more studies per year than their peers in other countries. Thus the overall evidence shows that the US has a relatively high number of scanners, radiologists, and scans per capita, which is consistent with it having relatively few controls on investment in new equipment and on licensure of new radiologists.

According to the Center for Medicare and Medicaid Services and Blue Cross Blue Shield Association, expenditure on diagnostic imaging has been approximately 5% of total expenditure on health care. The total amount of money spent on diagnostic imaging in the US in the year 2000 was approximately $75 billion. In 2000, the national health expenditure was $1.377 trillion, making imaging costs 5.4% of total health care expenditure. The total cost of diagnostic imaging for 2005 was estimated to be $100 billion. In 2005, the national health expenditure was $2.029 trillion, making imaging costs approximately 4.9% of total expenditure on health care.

Between 1998 and 2005, the annual growth rate in diagnostic imaging in the Medicare population was 4.1%. This has slowed down in recent years, likely as a result of a combination of cost-containment strategies from the government as well as the economic slowdown. Between 2005 and 2008, the annual growth rate of imaging in the Medicare population was 1.4% (Levin et al., 2011).

United Kingdom/England

England has a universal public health care system (National Health Service, NHS) with a supplementary private insurance system. Taxes are used to fund the NHS, where most care is provided at no cost to the patient at the point of service. Patients register with and go to a general practitioner (GP) who then serves as a gatekeeper between them and the hospitals/specialists, including radiologists who normally are employed in radiology departments within hospitals. Supplementary private insurance is purchased by about 12% of the population. It mostly pays for quicker access to specialists and elective surgeries, which may be performed in private hospitals or private beds in NHS hospitals. Anecdotally, private insurance provides a greater degree of access to imaging than the NHS. The private system is staffed largely by the same physicians who serve in the NHS.

In general, over the preceding decades, radiology in the NHS has been characterized by limited quantity of radiology equipment, limited number of radiologists, and waiting lists for patients. These issues have been tackled and have steadily improved.

While the density of radiology equipment per capita in England remains far lower than in the US, there has been a substantial upgrading of imaging equipment in England over the past decade. According to the UK Department of Health, during 2000–07 the NHS spent d564 million (d80 million per year) on CT, MRI, and LINAC (linear accelerator, for radiotherapy) machines in inflation-adjusted currency. The estimated cost to replace this equipment over the next decade is d1 billion, noting yearly NHS annual budgets of around d100 billion.

In 2001, there were 1586 consultant radiologists. In 2010, the number of full-time equivalent radiologists was 2194, representing an approximate 38% increase over the decade. This translates to approximately 45 full-time equivalent radiologists per million of population. Despite this increase, it is still below the Royal College of Radiologists recommendation of eight full-time equivalent radiologists per 100 000 of population, according to a December 2012 Center for Workplace Intelligence report. Universal evening and weekend coverage is not prevalent as is the case in the US. There is a drive toward longer hours, and 12–14 h days per radiologist, working 7 days per week has been implemented at Royal Sussex County Hospital in Brighton with reported success. In order to provide around the clock coverage, 24 h a day and 7 days per week, the number of radiologists would need to increase to 6000, which implies roughly doubling the current number.

In addition to high case volume, radiologists in England face additional work pressures. The NHS Cancer Plan requires that a radiologist be present at multidisciplinary meetings, which have increased in duration and frequency since 2007. These, on average, occupy 10% of the radiologists’ clinical time. In contrast, this is not a requirement in countries such as the US, where it is occasionally provided as a voluntary effort. This results in additional radiologist time taken away from reading films, exacerbating shortages. As in the US, an aging population and increasingly complex imaging examinations with an increased number of images per study, have also increased the clinical burden on radiologists. A Center for Workplace Intelligence report from August 2011 reports on burn out resulting in radiologists leaving the work force for sick leave or early retirement, as well as an increased rate of mistakes such as overlooked lung cancers on radiographs. A study from the Royal College of Surgeons of Ireland in March 2011 surveying Irish radiologists describes understaffing issues in a system in which radiologist numbers are centrally controlled by government agencies. The authors argue that current methods of determining radiologist productivity are outdated and do not give adequate weighting to responsibilities such as teaching, procedures, double reading, and interpreting outside films.

Private practice radiology does exist on a more limited scale than the US, providing 10–15% of radiology services, as per a July 2002 Audit Commission report. Fees for diagnostic exams vary from provider to provider, but in general align with fees charged in the US.

England has made progress in terms of patient wait times for imaging. An audit commission report in 2002 found the average wait time for outpatient MRI services was 20 weeks, while for CT this was over 6 weeks. In 2004 the NHS contracted with an independent sector radiology provider, Alliance Medical, to provide 635 000 MRI scans to assist with MRI backlogs. This served as a short-term solution to the waiting lists. However, there is concern from within the NHS radiology departments as to direct competition with the independent sector for limited NHS funds. According to the Department of Health, as of 2009, wait times over 6 weeks for CT and MRI have been essentially eliminated.

The OECD data show that as of 2012, health care spending in England is lower than in the US, accounting for 9.8% of GDP compared to 17.4% in the US. However, rising health care costs have led to recent reforms in the NHS. As per the Department of Health spending review, the budget of the NHS for 2011 is d103.8 billion, and the current budget provides a 0.4% increase in real terms through 2015. Overall planned cost cutting include d20 billion in efficiency savings and a 33% decrease in administrative costs. Specific to radiology, there will be an expected d8 million in savings annually to be achieved by having some plain radiographs interpreted by radiographers (nonphysicians) rather than radiologists.

In 2008/2009, d1.1 billion was spent on radiology services, equating to 1.4% of the NHS budget. This is a smaller percentage when compared to the US (Grant et al., 2012). About 38.8 million imaging examinations were performed in England in 2010, including 4 million CTs, 2.1 million MRIs, and 22.2 million radiographs, as per the Center for Workplace Intelligence. This volume amounts to approximately 73 imaging examinations per 100 population per year. There has been a rapid increase in volume of imaging in the UK, and between 1996 and 2010 there has been a 445% increase in MRI, 279% increase in CT, 94% increase in ultrasound, and a 16% increase in radiographs. As in the US, the increase has primarily involved the more advanced and expensive imaging modalities. Based upon calculations from the OECD health data, the US, in comparison, has had an increase of 208% in MRI, and 262% in CT.

Tables 1 and 2 show fewer CT and MRI scanners in the UK relative to the US. When accounting for the total number of scans performed, on average the UK seems to have a higher utilization of their imaging equipment. On a per radiologist basis, despite the aforementioned concerns of high case load and clinical burden, radiologists read on average less number of CT and MRI cases per year than their US counterparts. The difference between the countries might in part be attributable to the differential payment structure of radiologists. In the US, there is a financial gain for reading more studies, while in the UK there is no such overt financial benefit in their salaried model.

Canada

Canada has a single-payer universal health care system paid for through taxation. Cost containing strategies, such as patient copayments, are effectively prohibited for ‘medically necessary services’ by federal mandates. The roots of the Canadian health care system date back to the Federal Health Insurance and Diagnostic Services Act of 1957. The act provided that provinces funded 50% of the health care cost with a federal match of 50%. Federal funding was contingent upon the provinces providing medically necessary care, portability of coverage, and universal coverage. In 1977, the open-ended federal funding of health care was replaced with a federal per capita block grant, meaning a fixed amount of money would be provided to provinces every year, initially with indexing to the GDP. In the early 1990s, the federal contribution was frozen at 1989 levels, making the provinces responsible for all growth of spending. By 1999, the federal share of health care costs had fallen to between 10% and 20%. Until 2005, the Canadian system banned private insurance from providing services covered by public health insurance. In 2005, the Quebec Supreme Court ruled in Chaoulli versus Quebec that Quebec’s prohibition of private medical insurance in the face of long wait times for public federally mandated care violated ‘rights to life’ and ‘security of person’in Quebec’s charter. The provincial government has so far responded to this ruling by managing waiting times, rather than encouraging growth of private insurance.

The provincial contribution to health care is generally from income or payroll taxes that are not earmarked specifically for health care, and hence the amount of money individuals pay for health care is not obvious to the taxpayer. From 2001 to 2010, the rate of health care spending has increased at greater than three times the rate of inflation. Health care spending is projected to equal or exceed 50% of all revenue in 6 of 10 Canadian provinces by 2017 (Skinner and Rovere, 2011).

Every year the provincial government negotiates annual global budgets with the hospitals. The fixed budget covers all operating costs and is based on estimated volume of patients (occupied beds). New capital expenditures are allocated separately. There is a theoretical disincentive on the part of the hospitals to provide expensive services, unless this would result in increased revenue, which would typically only happen with a lag.

Physicians are primarily in solo practices (about 50% are GPs), and collect their revenues via a fee-for-service system but subject to an annual aggregate spending limit. Provinces and medical associations determine a uniform fee schedule that typically applies throughout the province. Expenditure and income caps per physician are put into place (varying from province to province), which are intended to prevent overutilization. After achieving a certain level of income (total fees), the physician is paid only a percentage of the remaining fees. Radiologists, in particular, are facing such ‘claw-backs’ proposed by provincial governments. Once total billings reach a certain level, the claw-back reduces payment of subsequent services by a fixed percentage. A 2012 Ontario proposal reduces payment by 5% for billings above $400 000, 10% over $750 000, 25% for billings over $1 million, and 40% for billings over 2 million. This reduced marginal benefit attempts to balance the incentive of reading too many scans. The concern of the claw-back scheme is the potential exacerbation of current waiting lists.

Canadian radiologists are paid primarily in a fee-for-service system. Based on data from the 2010 National Physician survey, 80% of diagnostic radiologists who responded received greater than 90% of their income from fee-for-service, while 10% received income from a blended source (which can include fee-for-service, salary, capitation, contract, on-call remuneration, etc.).

A small number of private radiology clinics do exist in Canada. As of 2007, there were 42 for-profit MRI/CT clinics in Canada. Traditionally these clinics have performed scans as a fee-for-service out of pocket payment and radiologists at these sites do not work in the public sector. Rates for scans in Alberta range between $500 and $800 per scan, while rates per scan in British Columbia range between $500 and $2200. To help combat public sector wait lists, they are now being used to help increase imaging capacity in the provinces via contracting with the public health service (Mehra, 2008).

As per 2010 data from the OECD, Canada spends 11.4% of its GDP on health care costs (Table 1). Estimated per capita spending for radiology in Canada is $55.29. This is closer to the spending of the UK, and considerably less than that of the US. According to the Canadian Association of Radiologists in 2012, costs of medical imaging in Canada (including maintenance of equipment and physician payment) is approximately $2.14 billion (US). Total health care expenditure is 11.4% of a GDP of $1.6 trillion (US), or $180.8 billion. Based on this, diagnostic imaging costs in Canada are approximately 1.2% of total health care expenditure. However, it should be noted that this does not include capital costs of scanner purchase. Taken at face value, the percentage is on par with the UK share of 1.4%, however much lower than the US share of 4.9%.

While a majority of Canadian citizens and physicians have an overall positive impression of the Canadian health care system, the system is not without criticisms. One criticism of the Canadian health care system has been with regard to long wait times. There is a low density of physicians in Canada that serves as one potential rate-limiting step with regard to overall health care spending. This holds true in radiology, with 67 radiologists per one million population, compared to 100 radiologists per million in the US. In addition to lower manpower availability, the density of expensive medical equipment such as MRI and CT scanners is also lower in Canada, potentially limiting access and resulting in long wait times. According to one survey released in 2009, the wait list for urgent MRIs ranged from 24 h to greater than 1 month, and the wait list for elective MRIs ranged from 28 days to 3 years. Other criticisms that have been raised in the past decade relate to slower adoption of new technology, which may in some cases and in some parts of the country lead to patients undergoing diagnostic and interventional procedures performed with less modern equipment than would be possible with more resources. Furthermore, due to the single-payer system, diagnostics and procedures that are reimbursed at a low rate or not at all by the public health system may be difficult for patients to obtain. As noted in Table 2, the number of CT and MRI scans interpreted per radiologist is less than their US counterparts, whereas Canada ties with the UK in having the highest number of scans per scanner. This suggests that availability of scanners or budget allocation to pay for scans are on average more often the limiting factors on patient access, rather than manpower.

Comparison between the UK and Canada, both with single-payer health care systems, shows similarities in the percent of radiology expenditure as a share of total health expenditure, as well as the per capita expense of radiology services. There are also strong similarities in scanner utilization. These similarities are in place despite the difference in payment models to radiologists, with Canada being fee-for-service and the UK being a salary model. It might be surmised that radiologists are not, therefore, in the driver seat of imaging utilization, and that it is the organization of the health care system that plays a more critical role.

Japan

Japan has a universal health insurance system. Health insurance is mandatory, with individuals receiving insurance either via employer-sponsored plans or via one of several government-sponsored health insurance plans. Health care spending as a percent of GDP is low in Japan relative to other industrialized nations – largely a result of the government’s tight regulation of health care prices. The system operates via a national fee schedule, reviewed biennially, which determines government reimbursement for all health care services. This single payment system has served as a remarkable control mechanism for costs.

Despite tight government control over reimbursement for imaging, there is no central government control on the installation of high-technology scanners in Japan. Japan has the most MRI and CT scanners per capita. The high density of MRI and CT scanners in Japan is an interesting phenomenon, because reimbursement for imaging in Japan is far lower compared to the US. For instance, the reimbursement for a CT scan in Japan in 2008 was equivalent to $80, with the reimbursement for an MRI equivalent to $155–180, these prices being approximately one-fifth to one-tenth of the reimbursement for the same studies in the US (Ehara et al., 2008).

The low level of reimbursement begs the question as to why Japanese hospitals and clinics would purchase so many scanners and perform such a high volume of imaging, and whether imaging in Japan is profitable. The answer in part is cultural and relates to the expectation for rapid diffusion of medical technology in the Japanese society, which is quick to believe in its benefits even in the absence of clinical effectiveness data. Medical imaging in Japan is in fact not typically profitable, yet hospitals reportedly seek high-technology scanners so as to maintain their prestige and competitive edge. The prestige of having an MRI scanner may attract more patients and increase profits indirectly from margins on other services. Furthermore, while the government reimburses imaging at a low rate, it does provide subsidies for purchasing imaging equipment by major public hospitals and academic medical centers (Ikegami and Campbell, 2005). Outside of major academic centers, private sector imaging providers who do not receive any government support tend to operate with lower cost Japanese-made scanners. The cost of imaging equipment in Japan is significantly lower than in the US, which also helps to explain the high density of scanners. Toshiba, Hitachi, and Shimadzu produce less expensive models of imaging equipment for sale to Japanese providers (Kandatsu, 2002).

A 2001 survey of scanners in Japan by the Japan Radiological Society revealed that approximately 30% of MR scanners were high-field 1.5 T scanners. A survey from 2005 showed that 53% of installed MRI scanners were 1.0 T or less. In comparison, a 2006 IMV market research survey of the US reported 90% of MRI scanners at 1.5 T field strength or greater. The strength of the magnetic field in MRI is measured in Tesla units, and higher Tesla scanners are stronger scanners. This increased magnetic field strength in MRI results in higher signal-to-noise ratio (SNR) in the resulting image. With high SNR, smaller structures and finer details are more easily visualized, which theoretically improves diagnostic accuracy. When comparing costs between superconducting scanners, in 2004, a 0.3 T scanner can cost around 70 million Yen (approximately $753 000), while a 1.5 T scanner can run 120 million Yen (approximately $1.3 million) (Hayashi et al., 2004).

Japanese fee schedules have been adjusted over time to reflect the increased use of MR and CT. As the volume of imaging increases, the government decreases reimbursement to control overall expenditures. For instance, in 2002 the reimbursement for an MRI brain exam was decreased from 16 600 Yen ($180 in US dollars, using early 2013 exchange rate) to 11 400 Yen ($124), an approximate 30% decrease. Over the past decade, there has been recognition that the higher cost of operation and the higher quality of imaging provided by higher field strength MRI scanners and multidetector CT deserves higher levels of reimbursement.

Other issues that distinguish the practice of radiology in Japan from that in the US, Canada, and England include the prevalence of interpretation of images by nonradiologists. In 1996, the government began offering higher reimbursement for studies interpreted by board-certified radiologists. While the proportion of studies interpreted by radiologists has increased since that time, only 40% of imaging examinations were interpreted by radiologists as of 2003 (Nakajima et al., 2008).

Of all of the countries included in this article, Japan has the lowest density of radiologists, with 36 per one million of population as of 2004. Japanese radiologists worked an average of 63.3 h per week in 2006. Cases read per radiologist, or radiologist utilization, are on par with the US when accounting for the 40% radiology interpretation rate. A 2002 survey from the European Society of Radiologists of 14 European countries showed that essentially all CT and MR examinations are reported by radiologists.

Japan’s total health expenditure is on the lower end of the spectrum when compared to the other countries analyzed in this article. In 2003, radiology costs were estimated to be approximately 5.2% of total health care expenditures (Imai, 2006). This is closer to the radiology share of spending in the US (4.9%), than in the UK and Canada.

Conclusion

Comparison of the four countries used in this study demonstrates important cross-national differences in the utilization of diagnostic imaging, both absolutely and as a percent of total health care spending.

On the side of total spending, the US and Japan have the highest percentage of total health expenditure utilized for radiology, at 4.9% and 5.2%, respectively. By contrast, the UK and Canada have the lowest percentage of total health expenditure utilized for radiology, at 1.4% and 1.2%. However, note that data for Canada do not include costs of scanner purchase, only operational costs. One of the major differences between these groups of countries is that the former (US and Japan) are not single public payer systems. And although the latter group (UK and Canada) do have a degree of private practice running alongside the single public payer, the public system is by far the dominant mode of health care delivery. Publicly owned providers are fundamentally not designed to make a profit on the delivery of care.

From the provider reimbursement standpoint, fee-for-service versus salaried model of radiologist pay does not, with this limited glance, account for significant differences. Canada is a fee-for-service system, while the UK is a salaried model, and both systems achieve a relatively low percentage of total health expenditure utilized for radiology.

In terms of access, Japan has the most scanners per capita but ranks second, after the US, in number of scans per capita. Utilization of equipment numbers, however, indicates that the UK and Canada use their equipment more intensively than the US and Japan, which is perhaps unsurprising given the former two countries’ lower number of scanners per capita. Access to imaging is related to the percentage of total health expenditure utilized for radiology.

Ultimately, it might be surmised that an ‘if you build it, they will come’ mentality exists within health care, and that single-payer models serve as a better mechanism to limit both imaging access and costs. Both the UK and Canada have government budget constraints that can tightly control number of scanners in the market. And while Canada pays the radiologist a fee-for-service model for interpretation of the scan, the performance of the scan is not reimbursed in this manner. Therefore, a potential strategy for countries attempting to reign in radiology expenditures is the elimination of technical fee-for-service, while preserving current mechanisms of radiologist interpretation reimbursement. Simply reducing the technical component fee may not be enough, as Japan has shown with its reduced fee schedule. The market response in Japan has been to utilize lower cost scanners, and the country has continued high radiology costs as a percentage of total health expenditure.

Further research is needed into whether technical fee-for-service reimbursement is a causative factor for higher costs, not just for medical imaging, but also for health care as a whole. The removal of technical fee-for-services, not merely the reduction of fees, in laboratory services, surgical and clinical services, in addition to imaging services could serve as a future direction of health care cost containment and health care policy.

References:

- Cutler, D. M. and Ly, D. P. (2011). The (paper)work of medicine: Understanding international medical costs. Journal of Economic Perspectives 25(2), 3–25. Spring.

- Ehara, S., Nakajima, Y. and Matsui, O. (2008). Radiology in Japan in 2008. American Journal of Radiology 191, 328–329.

- Fuchs, V. and Sox, Jr., H. C. (2002). Physicians’ view of the relative importance of thirty medical innovations. Health Affairs 20(5), 30–42.

- Grant, L., Appleby, J., Griffin, N., Adam, A. and Gishen, P. (2012). Facing the future: The effects of the impending financial drought on NHS finances and how UK radiology services can contribute to expected efficiency savings. The British Journal of Radiology 85(1014), 784–791.

- Hayashi, N., Watanabe, Y., Masumoto, T., et al. (2004). Utilization of low-field MR scanners. Magnetic Resonance in Medical Sciences 3(1), 27–38.

- Ikegami, N. and Campbell, J. (2005). Medical care in Japan. New England Journal of Medicine 333(19), 1295–1299.

- Imai, K. (2006). Medical imaging: It’s medical economics and recent situation in Japan. Igaku Butsuri 26(3), 85–96. Article in Japanese.

- Kandatsu, S. (2002). Modalities in Japan. Special Report. Japanese Radiological Society.

- Levin, D. C., Rao, V. M., Parker, L. and Frangos, A. J. (2009). The disproportionate effects of the Deficit Reduction Act of 2005 on radiologists’ private office MRI and CT practices compared with those of other physicians. Journal of the American College of Radiology 6, 620–625.

- Levin, D. C., Rao, V. M., Parker, L., Frangos, A. J. and Sunshine, J. H. (2011). Bending the curve: The recent marked slowdown in growth of noninvasive diagnostic imaging. American Journal of Roentgenology 196, W25–W29.

- Mehra, N. (2008). Eroding public Medicare: Lessons and consequences of for-profit health care across Canada. Ontario Health Coalition.

- Moser, J. W. (2006). The Deficit Reduction Act of 2005: Policy, politics, and impact on radiologists. Journal of the American College of Radiology 3, 744–750.

- Nakajima, Y., Yamada, K. and Imamura, K. (2008). Radiologist supply and workload: International comparison. Radiation Medicine 26, 455–465.

- Skinner, B. J. and Rovere, M. (2011). Canada’s Medicare bubble: Is government health spending sustainable without user-based fundings? Fraser Institute.